The Ongoing Housing Crisis: California Renters Still Struggle to Pay Rent Even as Counties Re-Open

Published On October 2, 2020

As we head into the seventh month of shelter-in-place orders related to the COVID-19 pandemic, the economic forecast and its implications for the housing market are decidedly murky. Gradual re-openings in many counties in California have led to a flattening of new unemployment claims and signs of economic recovery. However, the state’s unemployment rate remains in double digits (11.4 percent in August)1, and there are worrisome signs that the recovery is slowing.2 And in California’s supply-constrained housing market, the pandemic is leading to a widening of inequality, with house values increasing at the same time as homelessness.3

For renters and homeowners in California, the pandemic’s economic fallout is far from over, and hundreds of thousands of households are confronting housing insecurity from the combination of job and income losses, high housing cost burdens, and the threat of eviction and foreclosure. Newly released Census data 4 paint a sobering picture of how Californians are faring during the pandemic, particularly as the federal CARES act stimulus funds come to an end. Nearly 50 percent of households in California have lost employment income since March of 20205, and one in five households (20.7 percent) indicated that they have no or only slight confidence that they have the ability to pay their mortgage or rent next month.6

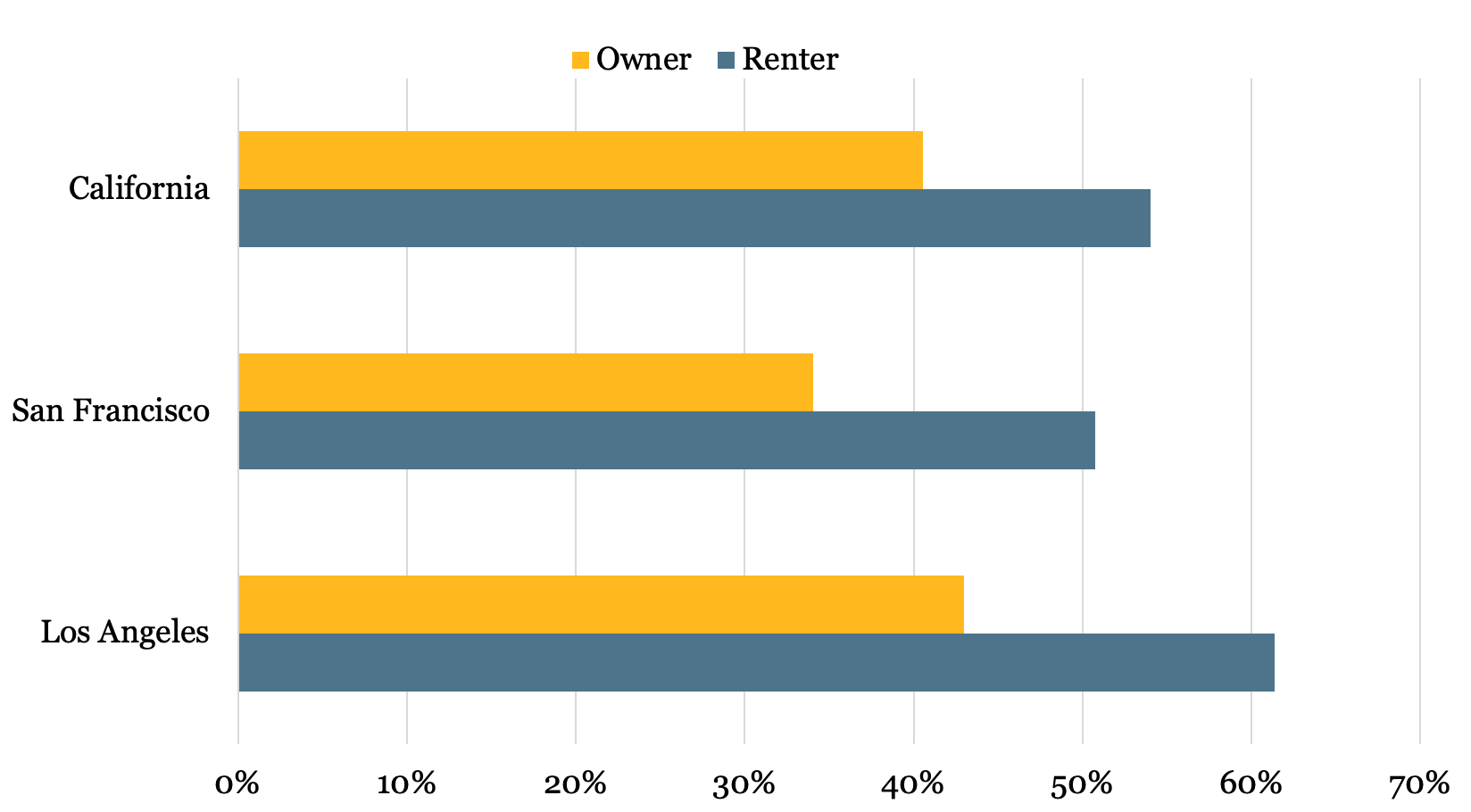

These income and job losses have hit rental households the hardest: nearly 55 percent of renters in California have experienced some loss of employment income since March when the shelter-in-place orders began (Figure 1). And although homeowners have fared better than renters, still 40 percent of homeowners have experienced a loss of employment income since March. Households in Los Angeles have been particularly hard hit, with more than 60 percent of renters reporting a loss of employment income.

Figure 1: Percent of Households Experiencing Loss of Employment Income since March 2020

Source: U.S. Census Household Pulse Survey, Week 13: August 19 – August 31

Source: U.S. Census Household Pulse Survey, Week 13: August 19 – August 31

Survey question: Have you, or has anyone in your household experienced a loss of employment income since March 13, 2020?

Notes: San Francisco refers to the San Francisco-Oakland-Berkeley metro area. Los Angeles covers the Los Angeles-Long Beach-Anaheim metro area. Includes all renter and owner households, including those who don’t have rent or mortgage obligations.

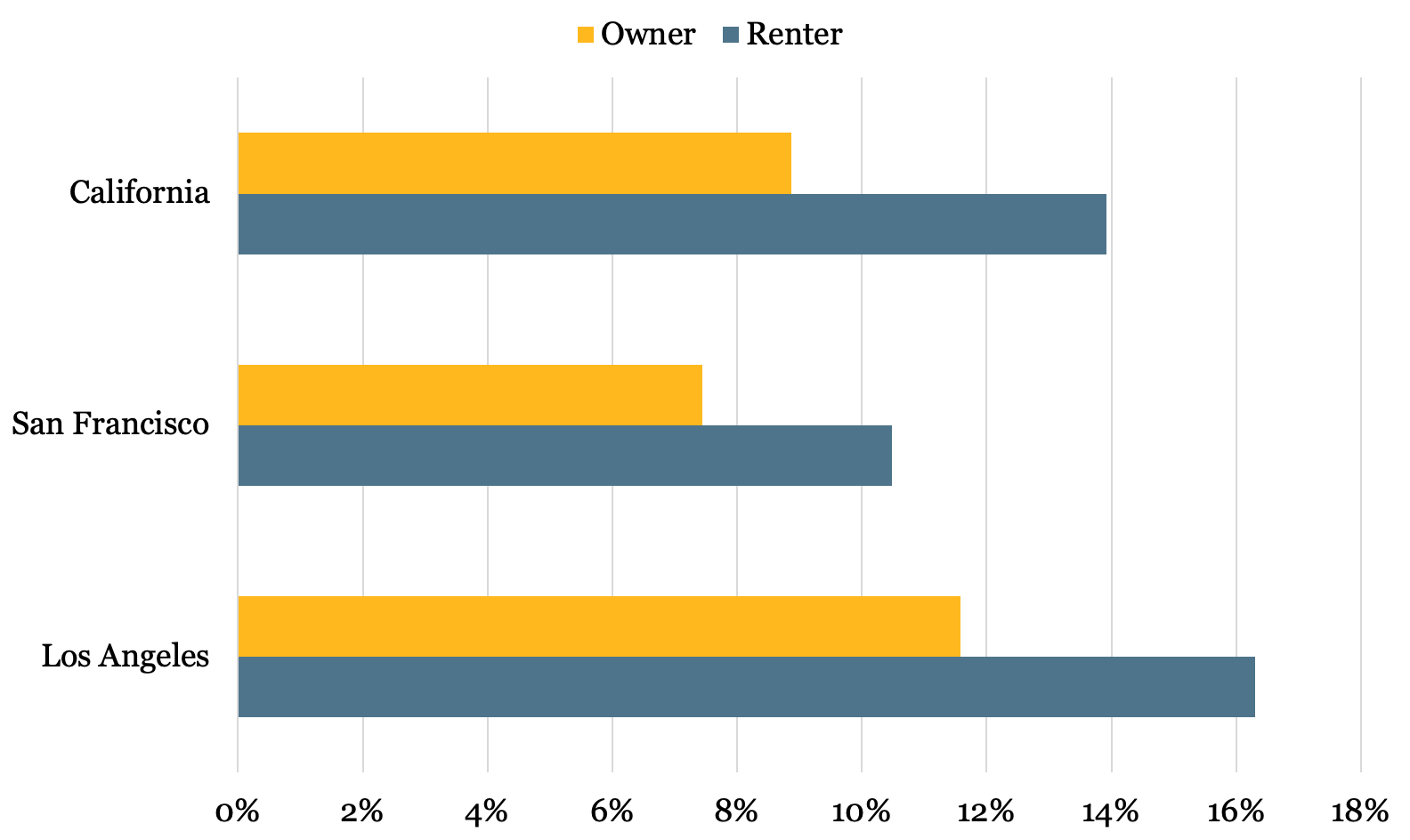

These income losses make it harder to stay current on rental or mortgage payments. In August, 14 percent of renters (597,000 households) and 9 percent of owners with a mortgage (337,000 households) in California were behind on their housing payment obligations (Figure 2).7

Figure 2: Percent of Households Behind on Housing Payments

Source: U.S. Census Household Pulse Survey, Week 13: August 19 – August 31

Source: U.S. Census Household Pulse Survey, Week 13: August 19 – August 31

Survey question: Is this household currently caught up on rent/mortgage payments?

A significant share of these households are worried about losing their housing: 42 percent of renters who were behind on their rent payments answered that they were somewhat or very likely to face eviction in the next two months. Homeowners were less likely to respond that they were concerned about a foreclosure: still, approximately 17.8 percent of homeowners behind on their mortgage payments reported that they were somewhat or very likely to enter into foreclosure in the next two months.8

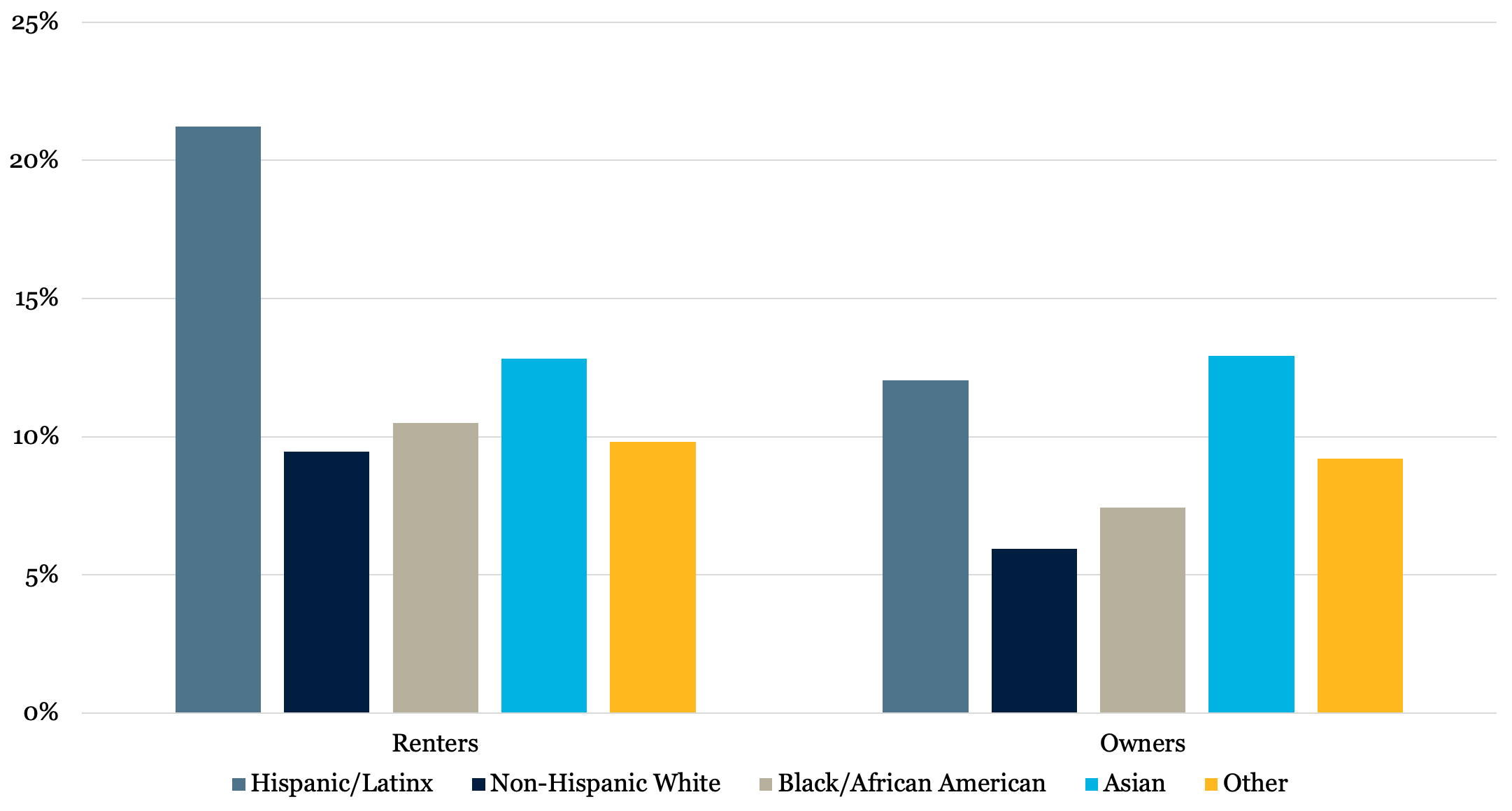

The data also show that households of color are more likely to be behind on their rent and mortgage payments than Non-Hispanic White households. Hispanic/Latinx renters have been hardest hit in California, with more than one in five households behind on rental payments (Figure 3). Among homeowners, Hispanic/Latinx and Asian households have the highest rates of non-payment, although Black and Other homeowners are also more likely to have elevated rates of mortgage delinquency compared to Non-Hispanic Whites. The high rates of mortgage delinquency for Asian households are particularly striking, and reflect the impact of the pandemic on employment sectors in which Asians often work: nearly a quarter of the Asian American workforce is employed in industries such as restaurants, retail, and personal services such as nail salons.9

Figure 3: Percent of California Households Behind on Housing Payments, by Race/Ethnicity

Source: U.S. Census Household Pulse Survey, Week 13: August 19 – August 31

Source: U.S. Census Household Pulse Survey, Week 13: August 19 – August 31

Survey question: Is this household currently caught up on rent/mortgage payments?

Notes: Black, Asian, and Other races are of Non-Hispanic ethnicity. Other includes respondents who indicated any other race or two or more races. Differences for Hispanic/Latinx, Black/African American, Asian, and Other are significantly different from Non-Hispanic households at a p < .001.

While current eviction moratoria and mortgage forbearance programs provide some respite from immediate housing insecurity, months of unpaid rent or mortgage payments are likely to stress household budgets when these protections end. Households with children are at greatest risk of experiencing this housing instability: 10.5 percent of households with children in California (more than 540,000 households) are behind on their rent or mortgage payments, compared to 5.0 percent of those without children. Research has demonstrated that housing instability and insecurity has a particularly negative impact on children, which can lead to long-term health and educational disparities.10

Households behind on their payments are also likely to experience prolonged financial instability, which may hinder their ability to catch up on missed payments in the future. Among households who have missed housing payments, 37.8 percent report having turned to credit cards or other loans to help cover household expenses. This is significantly higher than those who have not missed payments (27.3 percent), though it is likely that some households are turning to credit cards and debt to stay current on their rent or mortgage as well. For California households who were already housing cost-burdened, managing both high housing costs and rising debt repayment obligations is likely to be a challenge, even as the economy recovers.

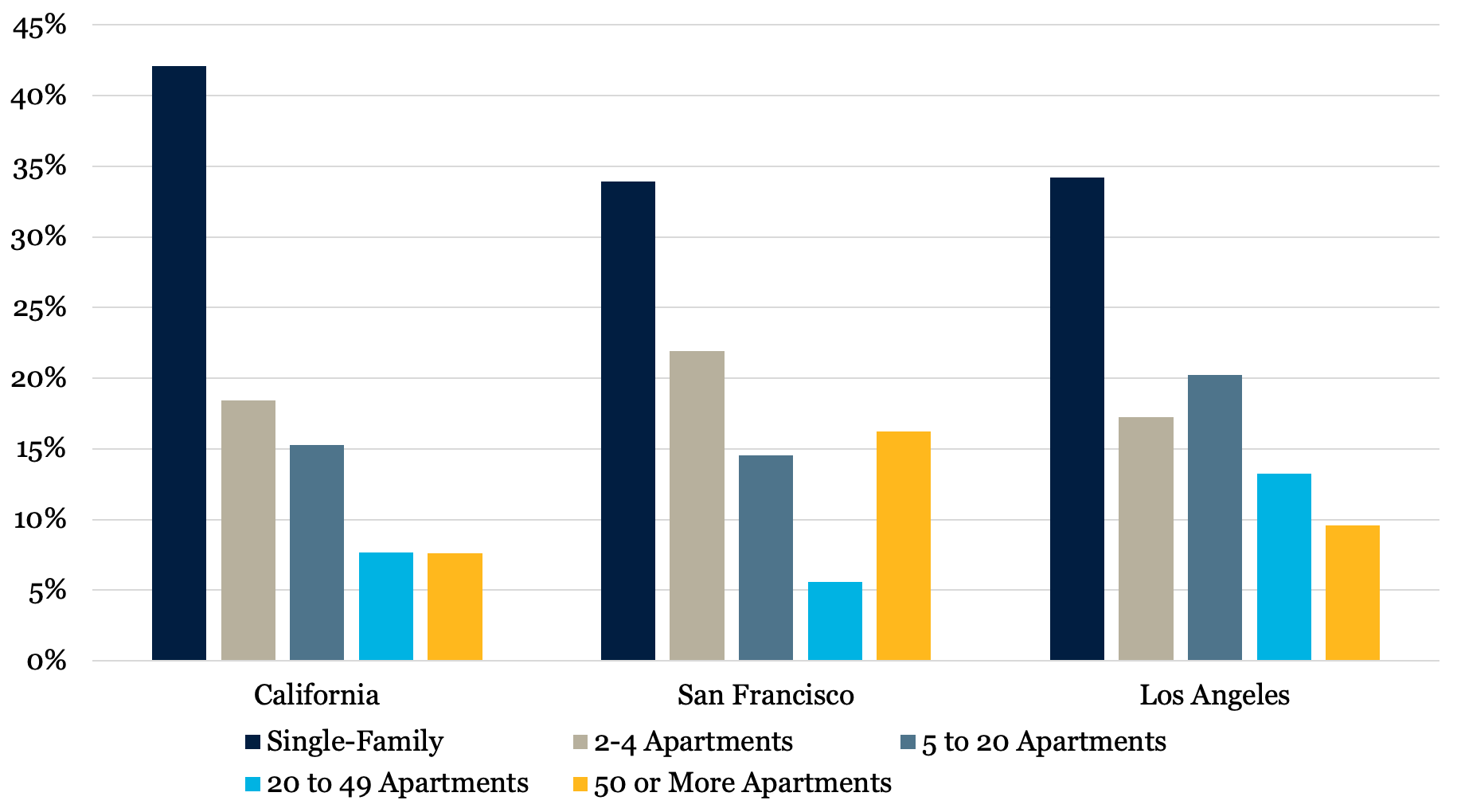

The nonpayment of rent also has implications for the landlords of these properties. The majority of households behind on their rent payments (60.6 percent) live in properties with 4 or fewer units (Figure 4). While this reflects in part the distribution of California’s housing stock (which skews to lower density developments), in both California and Los Angeles, renters in smaller properties are also more likely to be behind on their rent payments.11 (This finding aligns with the landlord survey we did with the National Association of Hispanic Real Estate Professionals in July.) The majority of these smaller properties are owned by either individuals or smaller property owners, who are more likely to have lower incomes and more likely to be people of color.12 Some evidence suggests that these smaller landlords may be more willing to work with renters to negotiate payment terms13, but they may also face larger barriers to covering shortfalls in their mortgage, property taxes, and/or insurance payments. These landlords may also be less likely to access small business support or payment protection programs, meaning that they will also be less likely to be able to keep on a tenant who can’t pay their rent over the long-term.

Figure 4: Percent of Renter Households Behind on Housing Payments, by Building Type

Source: U.S. Census Household Pulse Survey, Week 13: August 19 – August 31

Source: U.S. Census Household Pulse Survey, Week 13: August 19 – August 31

These findings reinforce the need for a stronger set of interventions that provide more robust income support for households who have lost their jobs or income due to the pandemic. Eviction moratoria—including California’s Tenant, Homeowner, and Small Landlord Relief and Stabilization Act and the national eviction moratorium put into place by the federal Centers for Disease Control—provide some immediate protection against the loss of housing. One critical piece of the puzzle will be ensuring that renters know their rights under these moratoria, and that the help that does exist (such as mortgage forbearance) is reaching the communities that need it most.

However, households will still owe back rent once these moratoria end, and on top of already high rent burdens in California, the added financial obligation of paying missed rents is likely to be unsustainable for many households. Eviction moratoria also do not address the financial crisis that is now enfolding for small property owners. Ultimately, the federal government needs to act with broad-based fiscal support. The CARES Act—though not perfect—did help cushion households from the impacts of COVID-19-related income loss, and likely prevented many households from becoming late on their rent and mortgage payments. Congress needs to prioritize the $2.4 trillion stimulus bill Speaker Nancy Pelosi and leading Democrats are working on, including provisions to provide both direct rental assistance and create a lending facility for landlords to stay afloat.14

Acting now to buffer households from income losses is necessary, but insufficient over the long-term. The recovery from the pandemic crisis is poised to be one of the more uneven in the country’s history, fueling increased inequality and exacerbating preexisting wealth and racial disparities in housing. Ultimately, averting an eviction and foreclosure crisis in 2021—and the negative implications such a crisis will have on households, neighborhoods, and the U.S. economy—will require a bolder, multi-faceted approach led by the federal government.

Citations

1. August’s unemployment rate of 11.4 percent marked the first month since March 2020 that California’s unemployment rate was lower than the 12.3 percent mark set during the height of the Great Recession (March, October, and November 2010). See: https://edd.ca.gov/Newsroom/unemployment-september-2020.html.↩

2. Horsley, S. (2020). “As Economic Recovery Slows, Fed Sees Many Risks and Pledges Full Support.” NPR. Retrieved from:https://www.npr.org/sections/coronavirus-live-updates/2020/09/16/913503551/as-economic-recovery-slows-fed-pledges-full-support.↩

3. Khouri, A. (2020). “There’s a pandemic, but Southern California home prices are at record levels.” The Los Angeles Times. Retrieved from:: https://www.latimes.com/homeless-housing/story/2020-09-23/southern-california-home-prices-jump-12-percent-in-august.

Hayes, R. (2020). “Signs of homelessness in Los Angeles growing worse during coronavirus pandemic.” ABC 7 News. Retrieved from: https://abc7.com/los-angeles-homeless-crisis-la-homelessness-during-coronavirus-covid-19-and/6305357/. ↩

4. U.S. Census Household Pulse Survey, Week 13: August 19 – August 31. When the pandemic hit, the Census launched an effort to collect timely information on household circumstances, fielding a bi-weekly “Household Pulse” survey and making the data available on its website. Microdata (the raw data), which we use for this study, are released two weeks after summary tables. The data are not perfect: the sample size is small, which precludes detailed analysis at the local level. In addition, while there are concerns with any survey about who responds and the accuracy of their responses, these concerns are heightened when we take into account the uncertainty and stress caused by the pandemic. Despite these caveats, the data provide a valuable snapshot into the impacts of the pandemic and who is most affected. For more information on the Household Pulse methodology, see: https://www2.census.gov/programs-surveys/demo/technical-documentation/hhp/Phase2_Source_and_Accuracy-Week%2013.pdf.↩

5. Does not include respondents who did not answer the income loss question. Calculations in this brief use household weights to adjust the sample responses to the broader population. As a result, numbers in this brief will look different from those presented in the Household Pulse tables, because the Census is reporting those figures using population weights.↩

6. Does not include respondents who did not answer the question or said that their payments had been deferred.↩

7. Does not include respondents who did not answer this question. ↩

8. The survey question asked: How likely is it that your household will have to leave this home or apartment within the next two months because of eviction (for renters behind on payments) or foreclosure (for owners behind on payments)? Calculations do not include those who did not respond to the question.↩

9. Horsley (2020). “’Overlooked’: Asian American Jobless Rate Surges But Few Take Notice,” NPR. Retrieved from: https://www.npr.org/2020/10/01/918834644/overlooked-asian-american-jobless-rate-surges-but-few-take-notice. ↩

10. Jelleyman, T. & Spencer, N. (2008). “Residential Mobility in Childhood and Health Outcomes: A Systematic Review.” Journal of Epidemiology and Community Health 62 (7): 584–592. Haynie, D.& South, S. (2005). “Residential Mobility and Adolescent Violence.” Social Forces 84:361–74. Clair, A. (2019). “Housing: an Under-Explored Influence on Children’s Well-Being and Becoming.” Child Ind Res 12, 609–626.↩

11. In San Francisco, the highest delinquency rates adjusting for building stock are in buildings with 50 units or above. These buildings are home to 16.2 percent of delinquent renters, but make up just 12.4 percent of the housing stock.↩

12. Goodman, L. & Choi, J.H. (2020). “Black and Hispanic Landlords Are Facing Great Financial Struggles because of the COVID-19 Pandemic. They Also Support Their Tenants at Higher Rates,” The Urban Institute. Retrieved from:https://www.urban.org/urban-wire/black-and-hispanic-landlords-are-facing-great-financial-struggles-because-covid-19-pandemic-they-also-support-their-tenants-higher-rates. ↩

13. Ibid. ↩

14. Cochrane, E., Rappeport, A., & Smialek, J. (2020). “Democrats Prepare New Stimulus Plan as Time Wanes for a Compromise.” The New York Times. Retrieved from: https://www.nytimes.com/2020/09/24/us/politics/hosue-democrats-stimulus-coronavirus.html.↩