New FAIR Housing and Opportunity Maps for California

Published On November 21, 2017

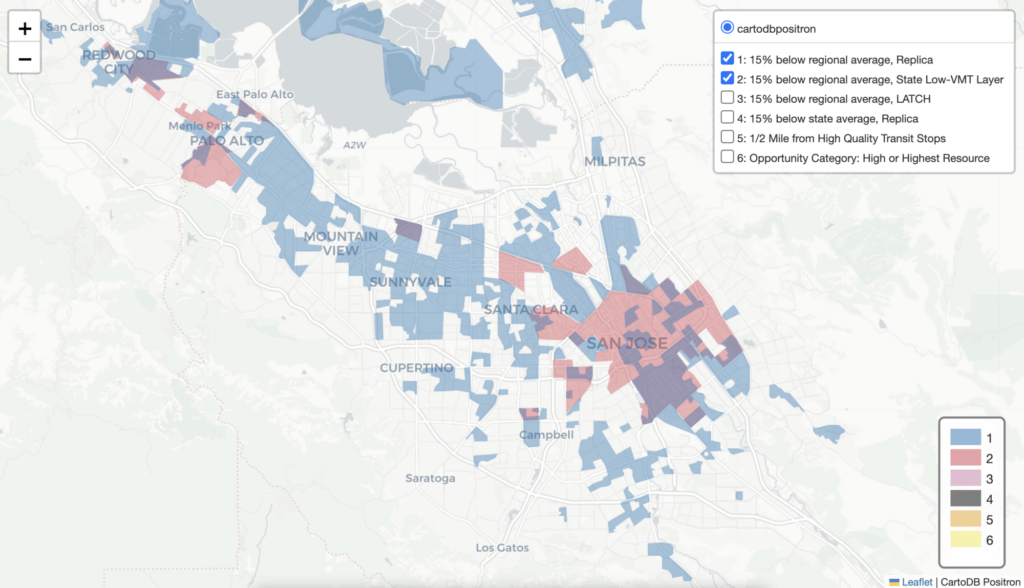

California’s Tax Credit Allocation Committee recently passed a number of policy changes aimed at improving the way housing tax credits are allocated for the production of new affordable housing units. The Terner Center played an important role improving the methodology that defines and identifies “places of opportunity” in the state – a key component driving where housing is located. Read the post here.