How Housing Supply Shapes Access to Opportunity

Published On November 13, 2019

In the past few decades, as housing production has slowed, albeit unevenly, and new ownership production has shifted toward larger format, single-family homes, a tightening housing market has seen increasing price pressures, particularly for entry-level homebuyers and renters.

To better understand the impact of trends in housing production on who can buy a home, particularly at the entry level, and the barriers renters face in gaining access to higher opportunity neighborhoods, the Terner Center for Housing Innovation undertook an analysis of how characteristics of housing production have shifted over time in the nation’s 100 largest metropolitan areas.

Today, the Terner Center is pleased to release two new papers based on this analysis.

The first paper “How Housing Supply Shapes Access to Entry-Level Homeownership” shows that, against this backdrop, the availability of entry-level stock has diminished and typical bottom-tier home prices have increased in more than two-thirds of the nation’s major metro areas. As prices have climbed, the profile of recent homebuyers has shifted. In 2016, recent homebuyers had significantly higher incomes, were older, and were less likely to be Black compared to recent homebuyers in 2000. Yet, where available, homes in the bottom price-tier and new construction that provided smaller-format and multifamily options served a more diverse population of homeowners.

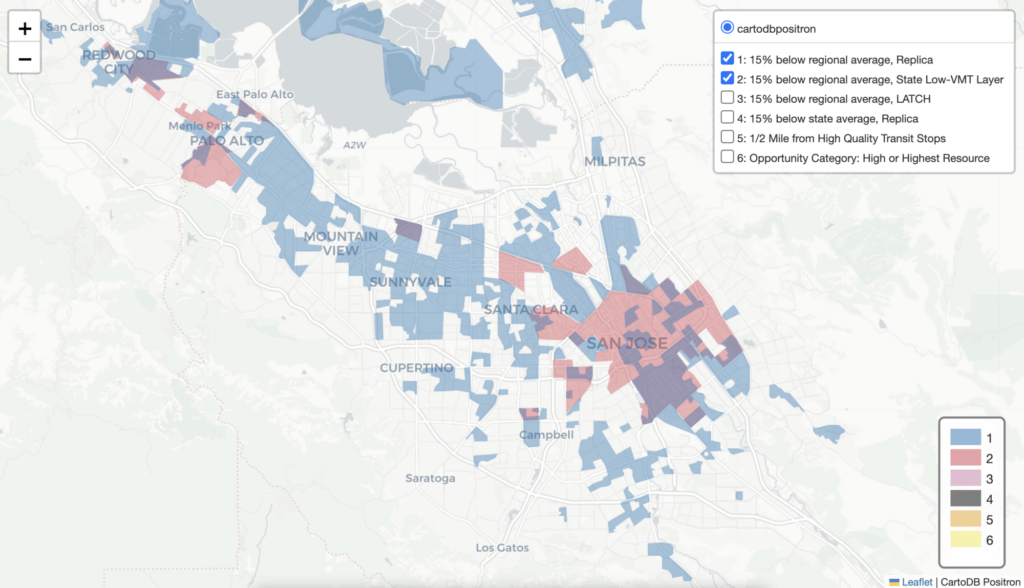

These production trends and how they play out at the neighborhood level also shape the kinds of communities renters, and particularly lower-income renters, can access. The second paper “How Housing Supply Shapes Access to Opportunity for Renters” shows that, as single-family housing dominated national production trends, it also spurred the spread of Single-Family neighborhoods in the nation’s 100 largest metropolitan areas. The number of Single-Family neighborhoods (tracts where at least 90 percent of the housing is 1-unit homes) in the 100 largest metro areas has increased by almost 40 percent since 1990, largely at the expense of neighborhoods with more mixed housing types.

While Single-Family neighborhoods score highest on a range of opportunity characteristics than other types of neighborhoods, new construction of affordable rentals, and even single-family rentals, has largely bypassed these areas of opportunities.

Noting that demand-side strategies are also essential, the papers outline supply-side strategies that would help to improve access to entry-level ownership and to areas of opportunity for lower-income renters, including reforming restrictive zoning practices that constrain the amount and type of housing stock produced, and aligning subsidies, financial incentives, and state and federal regulations in ways that support production of more diverse and affordable homeownership and rental options.

Read the papers, and explore the supporting data resources, here.