Unpacking the Growth in San Francisco’s Vacancies

Published On February 26, 2019

As part of our commitment to the education and professional development of UC Berkeley students, the Terner Center highlights exceptional student work that connects to our mission and research agenda. The analyses and policy proposals put forth in these projects may not be reflective of the official position of the Terner Center.

As part of our commitment to the education and professional development of UC Berkeley students, the Terner Center highlights exceptional student work that connects to our mission and research agenda. The analyses and policy proposals put forth in these projects may not be reflective of the official position of the Terner Center.

A Client Report submitted in partial satisfaction of the requirements for the degree of Master of City Planning in the Department of City and Regional Planning of the University of California, Berkeley, May 2018. The full report is available here.

Author: Paige Dow

Reviewers: Carolina Reid, Carol Galante, and James Pappas

High vacancy rates typically signal a weak housing market, where supply has outrun demand, and rents have stagnated. However, in San Francisco—as well as in many other high-cost cities such as Vancouver, London, and New York—we see a different phenomenon: an extremely tight housing market with skyrocketing rents, and a puzzlingly high vacancy rate. This report explores the characteristics of San Francisco’s vacant housing stock, as well as the factors contributing to San Francisco’s high vacancy rate. The report analyzes geographic concentrations of vacancy, characteristics of vacant units, and trends in vacancy over time, and presents new qualitative interviews with property managers, property owners, and brokers to try to understand some of the reasons properties may be held off the market.

Report Summary

High vacancy rates typically signal a weak housing market, where supply has outrun demand, and rents have stagnated. However, in San Francisco—as well as in many other high-cost cities such as Vancouver, London, and New York—we see a different phenomenon: an extremely tight housing market with skyrocketing rents, and a puzzlingly high vacancy rate. In San Francisco, approximately 30,000 units (or almost nine percent of San Francisco’s total housing stock) were sitting vacant according to the 2015 American Community Survey (ACS). Returning these units to the market represents an efficient strategy, in tandem with the production of more new units, for addressing the region’s severe supply constraints. (1)

The issue of vacant units in San Francisco has gained political and public attention, as talk of a vacancy tax has gained momentum in the City and the region. Measure W in Oakland, which was passed in November 2018, represents one effort in a growing number of localities to consider vacancy taxes as a piece of the puzzle in addressing supply constraints. Yet despite the buzz, we know relatively little about what has been driving an increase in vacant units in San Francisco since 2000, (2) and where these vacant units are concentrated. Understanding this dynamic is crucial to identifying the proper policy responses.

My report, a capstone project completed for my Master’s of City Planning, explores the characteristics of San Francisco’s vacant housing stock, as well as the factors contributing to San Francisco’s high vacancy rate. Using a variety of data sources such as ACS Data, Census data, Single Room Occupancy (SRO) data, Airbnb data, and housing permit data, I analyzed geographic concentrations of vacancy, characteristics of vacant units, and trends in vacancy over time. I also collected primary data through interviews with property managers, property owners, and brokers to try to understand some of the reasons properties may be held off the market.

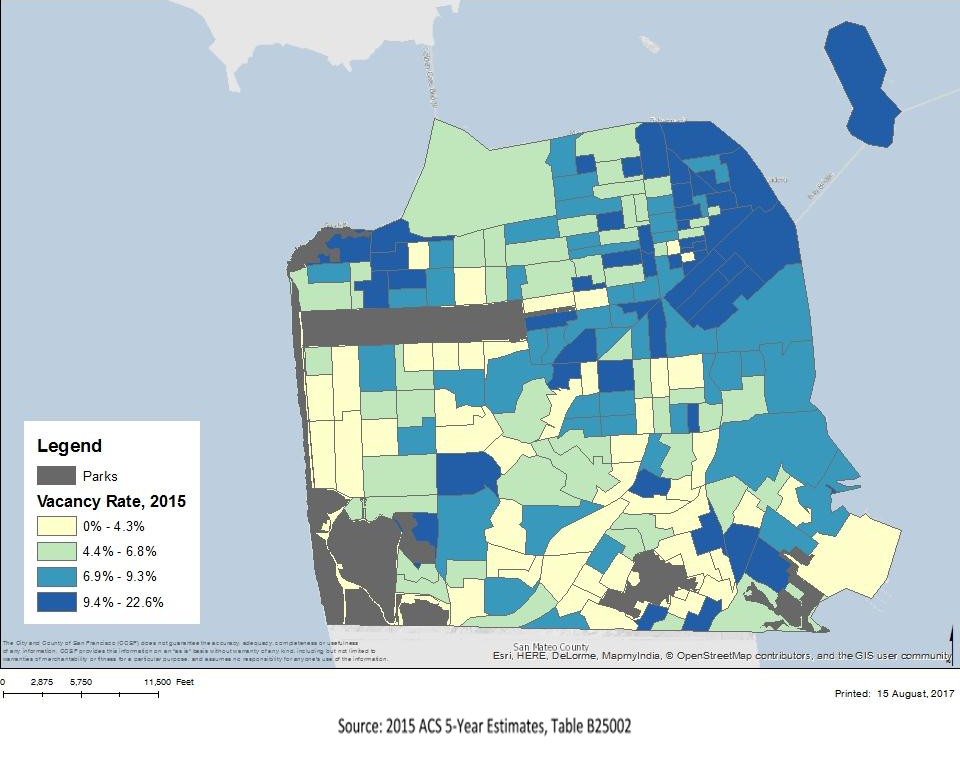

There appears to be no single driving force behind San Francisco’s increase in vacant units. San Francisco’s housing market and housing crisis are complex, and a combination of many factors are likely contributing to this vacancy increase. While most vacancy is concentrated in the upper Northeast quadrant of the city, as shown in Figure 1, Airbnb listings (which represent “vacant” units because they are not occupied full-time) appear to be more highly concentrated in the Mission and the Western Addition/Castro Valley neighborhoods. Additionally, while major renovations (defined as permits for work over $50,000) are correlated with increases in vacancy, concentrations of vacancy and major renovations appear to overlap only in a select few neighborhoods. I found that the location of for-profit SROs was correlated with vacancy. This may be because SRO owners have been known to rent out units to tourists rather than use them as rental units, rendering them “vacant” by my definition. However, these properties contribute only a small portion of the total increase in vacancy in San Francisco. It is also important to acknowledge that recent regulations (3) have aimed to address the impacts for-profit SROs and short-term rentals have had on the housing market, but the data used in this paper’s analysis predates those regulations.

Figure 1: Geographic Concentration of Vacancy Rate by Census Tract

My interviews offered different, and sometimes conflicting, explanations of why certain types of units might be vacant. For example, many interviewees discussed the influence of rent control. Some believed rent control decreased vacancy because “tenants are informed” and come to landlords and property owners “looking for rent-controlled units.” Others believed rent control increased vacancy as landlords either remove units from the market (to avoid the regulation) or take longer to find the right tenant because you only get “one bite at the apple,” as one interviewee put it. However, rent control has been in place in San Francisco since well before the starting point of this analysis in 2000 (although aspects of the tenant protection laws have changed). With my quantitative data, I cannot assess whether rent control laws are contributing to San Francisco’s vacant housing stock. Overall interviews suggest that it is likely the combination of a multitude of factors, rather than any single contributor.

This complexity argues for the utility of a vacancy tax as a method of addressing vacant units, irrespective of the cause. A vacancy tax—which if modeled after the Vancouver vacancy tax could target units that are unoccupied for more than six months of the year —may be a more effective strategy to incentivize units being placed back onto the rental market than policies that target individual factors that impact vacancy rates (i.e. Airbnbs and SROs). Whether or not a vacancy tax is ultimately pursued and implemented in San Francisco, it is clear that addressing vacancies needs to be part of an overall strategy to increase access to housing in the city.

(1) The definition of vacancy used in this blog and my report is gross vacancy rate (calculated by dividing the number of vacant units by the total number of housing units). This is different from the vacancy rate definition most commonly used to analyze housing markets: the rental vacancy rate (calculated as the total number of units for rent divided by the total number of rental units). Under this latter metric, San Francisco’s vacancy is extremely low at 2.6% according to ACS 2015 1-Year estimates, suggesting a high demand for rental housing and a tight housing market. It is important to note that there is always some vacancy in a housing market, and that no matter how tight the market, it would be infeasible to return all vacant units to the market. The gross vacancy rate, used in this paper, serves as a starting point for understanding the total universe of vacant units, including those vacant for “seasonal, recreational, or occasional use.”

(2) While vacancy has declined between 2010 and 2015, my report uses 2000 as a base year, a time of similar economic prosperity in the region that would therefore theoretically have similar vacancy rates and housing market dynamics.

(3) For example, San Francisco passed regulations limiting the length of entire-unit short term rentals to 90 days per year and requiring all hosts to register with the City. Listings on popular short term rental sites such as Airbnb have dropped dramatically since the implementation of these regulations.