What Small Multifamily Rental Property Owners Tell Us About Implementation of Tenant Protection Laws

Published On May 10, 2024

Author: Shazia Manji, Research Associate

Though roughly 35 percent of the US population lives in rental housing, no comprehensive or uniform set of laws protects tenants across cities and states. Instead, a patchwork of local, state, and federal policies regulate rental properties. As the housing crisis has escalated, advocates and policymakers have pushed for and passed new laws to protect tenants from evictions, rising rent burdens, and discrimination. But passing new laws is only half the battle. Proactive education and enforcement is crucial to ensure that owners are aware of and abiding by these new laws, and that renters realize their intended benefits.

Education and enforcement may be especially important for owners of smaller properties. These owners tend to be less professionalized than those with larger properties. Unlike large corporate owners for whom renting is a business, they tend to be individuals who manage a small number of units part time or for retirement income. They are more likely to rent their units below market, but may be less familiar with the patchwork of laws and regulations that govern their properties.

To shed light on this issue, we draw on results from a national survey of owners of small multifamily rental properties (those with 5 to 49 units) conducted between July and September of 2022. Totaling about 8.2 million units, these properties make up 17 percent of the nation’s rental housing—and are a significant source of unsubsidized affordable housing. Our recently published study, Ownership and Management of Small Multifamily Rental Properties, provides a snapshot of this part of the market, and highlights the importance of preserving these properties.

We asked owners about six different types of tenant protection laws (Figure 1), including whether they believed these laws applied to the property surveyed. Versions of these laws have been passed by cities, counties, and states across the country. Some have been in place for decades, while others have only recently been enacted. In this analysis, we share survey findings about owner awareness and perceptions of the tenant protection laws across the country and in California.

Figure 1. Tenant Protection Laws at a Glance

| Tenant Protection | Description | Example |

| Rent Control or Stabilization Laws | To help maintain housing affordability and protect tenants against egregious rent hikes, rent control or stabilization laws set limits on how much rent can be charged or raised. | In California, AB 1482 (2019) caps annual rent increases for existing tenants at 5% + inflation, or 10%, whichever is lower. The law does not apply to properties less than 15 years old, non-corporate-owned single-family rentals, and owner-occupied duplexes. |

| Fee Regulations | Fee regulations set limits on fees that can be charged to tenants—such as security deposits and late rent or move-in fees. | In Chicago, the Residential Landlord Tenant Ordinance limits late rent fees to $10 per month on rents under $500 plus 5% per month on any amount exceeding $500. Certain properties are exempt—for example, units in owner-occupied buildings with six units or less, employee housing, and school dormitories. |

| Just Cause Eviction Protections | Just cause eviction laws require landlords to have a “just cause” to evict a tenant, such as violating the terms of the lease. | In Oregon, SB 608 (2019) limits no-cause evictions for renters who have lived in their home for at least a year. Landlords may end a lease if the tenant violated the lease terms or for one of four “landlord-based” reasons defined in statute. Landlords must pay tenants relocation assistance. The law does not apply to owner-occupied properties with two units or less. |

| Source of Income Protections | The practice of refusing to rent to someone with a tenant-based subsidy—like a Housing Choice Voucher—is known as “source of income discrimination.” These protections ban landlords from discriminating against applicants based on their source of income. | As of 2009, Miami-Dade County’s civil and human rights ordinance of the County Code includes source of income—including but not limited to Section 8 Housing Choice Vouchers—as a class protected from housing discrimination. |

| Ban the Box Policies | “Ban the Box” policies aim to reduce barriers to housing for people with criminal records. These policies prohibit landlords from considering an applicant’s criminal record during tenant selection. | Seattle’s Fair Chance Housing Ordinance (2017) prohibits rental property owners from denying applicants housing based on their arrest record, conviction, or criminal history. The law does not apply to owner-occupied single-family dwellings or accessory dwelling units. |

| Right to Counsel Laws | Right to Counsel laws guarantee free legal representation to renters facing eviction. These laws aim to prevent unnecessary evictions by ensuring that low-income renters have access to representation during court proceedings. | Under New York City’s Right-to-Counsel law (2017), tenants facing eviction in Housing Court or New York City Housing Authority administrative proceedings are guaranteed access to free legal representation and advice provided by nonprofit legal services organizations. |

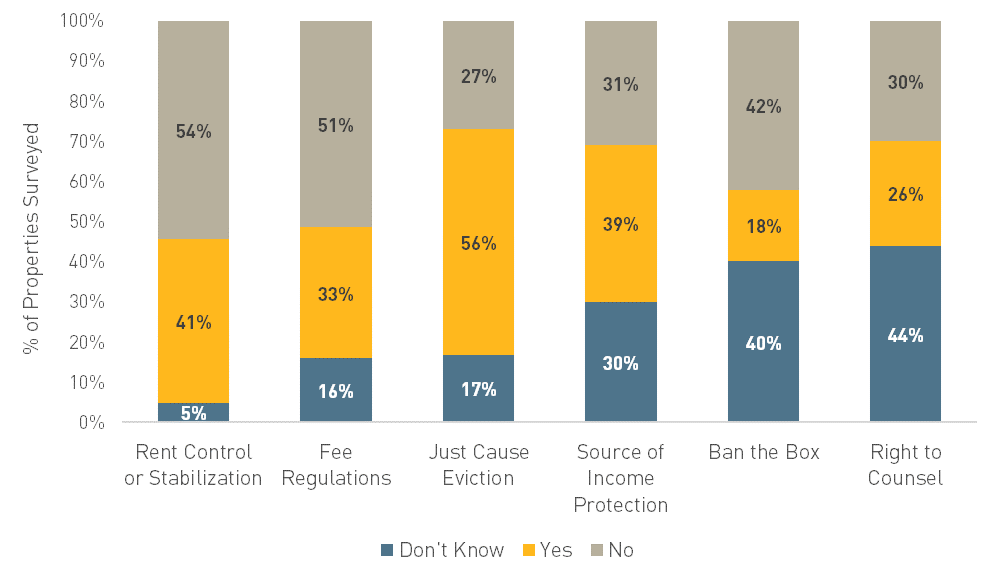

Landlord awareness of different types of tenant protection laws varied substantially (Figure 2). Surveyed owners were most likely to be aware of rent control and stabilization laws—only 5 percent reported that they were unsure whether the property surveyed was subject to some kind of rent control. Uncertainty was greater about other types of tenant protections. For example, 30 percent did not know whether source of income discrimination was prohibited. Moreover, 40 and 44 percent respectively did not know if the law banned examination of criminal records during tenant selection (Ban the Box) or guaranteed tenants legal representation during eviction proceedings (Right to Counsel).

Figure 2. Presence of Tenant Protection Laws, as Reported by the Property Owner

Source: 2022 Terner Center Survey.

Source: 2022 Terner Center Survey.

Note: Sample sizes range from 755 to 761, depending on the policy asked about.

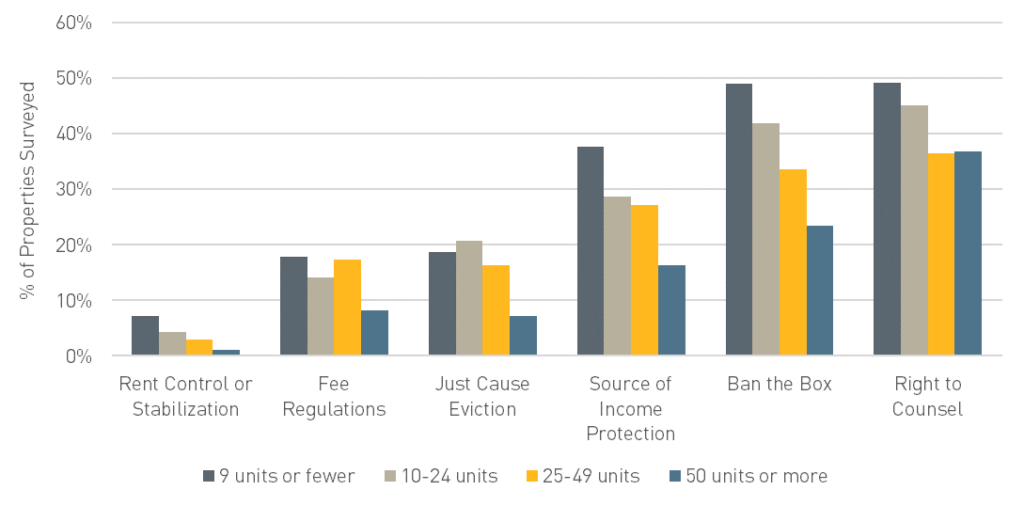

Compared to larger-scale owners, smaller-scale owners were less likely to know whether these policies applied to their properties (Figure 3). For example, 38 percent of landlords with the smallest portfolios (less than ten units) reported not knowing if the property surveyed was governed by a source of income discrimination law, compared to 16 percent of landlords with the largest portfolios (50 units or more). Nearly half of these smaller-scale landlords reported not knowing if there was a Ban the Box or Right to Counsel law in place.

Figure 3. Owner Unaware if Policy Applied to Property Surveyed, by Portfolio Size

Source: 2022 Terner Center Survey.

Source: 2022 Terner Center Survey.

Note: Sample sizes range from 686 to 692, depending on the policy asked about.

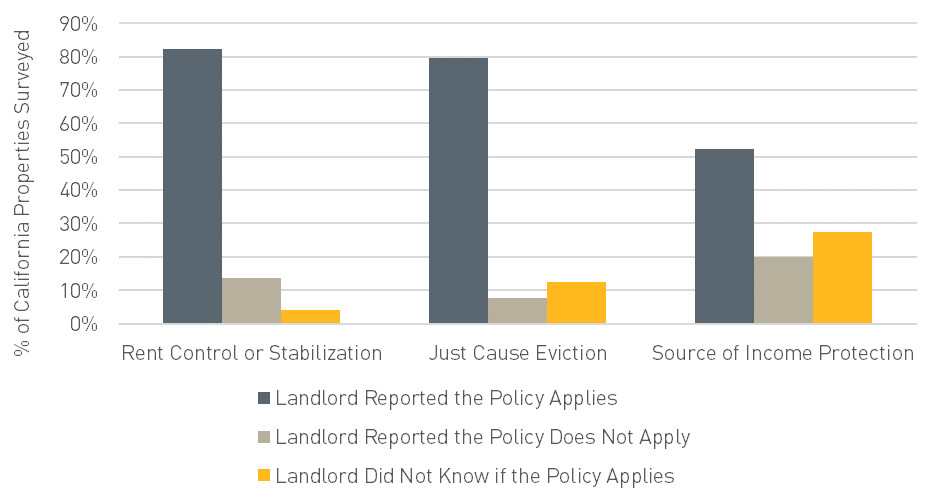

In addition to expressing uncertainty about which tenant protection laws are in place, landlords may sometimes be wrong about whether certain policies apply to their properties. To evaluate the accuracy of landlord awareness, we analyze the extent to which surveyed rental property owners in California knew whether their properties were covered by three types of tenant protection laws—rent control or stabilization, just cause eviction, and source of income protections—passed at the state level in 2019. Assembly Bill 1482 (2019) created a rent cap that limits the amount rent can increase year-over-year, and requires landlords to have a “just cause” to evict tenants. Senate Bill 329 (2019) made it illegal for landlords to discriminate against tenants based on their source of income.

Owners in California were more likely to know that they were subject to rent stabilization and just cause eviction policies than source of income protections (Figure 4). About 80 percent of respondents correctly identified the presence of these two protections; 14 percent reported incorrectly that the law did not set limits on rent changes for their property, and eight percent reported that no just cause eviction protections applied. An important caveat is that we were not able to assess whether landlords were specifically aware of AB 1482. Many jurisdictions in California have their own rent control and just cause eviction ordinances, and owner awareness of these protections may reflect knowledge of local protections, rather than AB 1482.

Figure 4. Awareness of Tenant Protection Laws Among Owners of Properties Surveyed in California

Source: 2022 Terner Center Survey. Notes: For rent control or stabilization and just cause eviction, data above excludes surveyed properties built after 1999. AB 1482 does not apply to properties built within the last 15 years. Sample sizes range from 246 to 254, depending on the policy asked about.

Source: 2022 Terner Center Survey. Notes: For rent control or stabilization and just cause eviction, data above excludes surveyed properties built after 1999. AB 1482 does not apply to properties built within the last 15 years. Sample sizes range from 246 to 254, depending on the policy asked about.

Only half (52 percent) of owners in California correctly reported the presence of source of income protections, as codified in 2019 by SB 329 (Figure 4). One in five incorrectly reported that no such policy applied to their property; another 28 percent did not know if such a policy existed. Among owners who either incorrectly reported that no source of income protection law applied or who did not know whether such a law existed, 44 percent said that they would not rent to a tenant with a Housing Choice Voucher. Research has shown that voucher holders successfully find housing more often in places with source of income protections. Landlord lack of knowledge undermines the effectiveness of these protections.

Education and proactive enforcement are critical for ensuring that renter rights are realized. Survey respondents’ uncertainty about and unfamiliarity with tenant protections highlights the need for ongoing landlord education about their responsibilities under existing law. Given the fragmented nature of these laws and regulations, it can be challenging for property owners and tenants alike to stay up-to-date on the shifting landscape of protections in different cities and states. In some cases, reducing the patchwork of protections—by limiting statutory carve-outs and exceptions, or defining new or expanded federal protections—can help create a better baseline for renter rights. For example, prohibiting source of income discrimination at the federal level would eliminate ambiguity about policy coverage while also increasing fairness in rental search processes and effectiveness of tenant-based government subsidies, like the Housing Choice Voucher program, across the country.

However, education and outreach alone may not always be sufficient. Having an enforcement agency with an audit or oversight role may be necessary to achieve robust compliance. Violations of tenant protection laws and housing discrimination against protected groups like people of color, sexual and gender minorities, and people with disabilities are notoriously difficult—even for affected tenants—to detect., In most situations, violations are only inspected if a tenant files a complaint, putting the burden on renters to ensure that their rights are enforced. Increasing the effectiveness of tenant protection policies will require accountability mechanisms, such as additional reporting requirements for landlords, better data infrastructure, and proactive enforcement strategies. Broadly, additional funding for and expanded access to legal services is also needed to ensure that tenant protection laws are enforced, that legal proceedings are fair, and that unnecessary evictions are avoided.