What the Small-Scale Rental Property Market Tells Us About the Rollout of Emergency Rental Assistance

Published On September 7, 2021

On August 26th, the U.S. Supreme Court struck down the Biden administration’s latest eviction moratorium. While some state and local governments have also imposed eviction moratoria, these are temporary and face their own legal challenges.

The rollback of these protections comes at a time when over 6 million renters report that they have fallen behind on rent payments, with some tenants accumulating arrears of $10,000 or more. While millions of tenants and landlords have benefited from the nearly $50 billion in rent relief funds the federal government has made available, the rollout of state and local programs to disburse these funds has been slow and uneven. To date, only about $6 billion in relief has been distributed across the country.

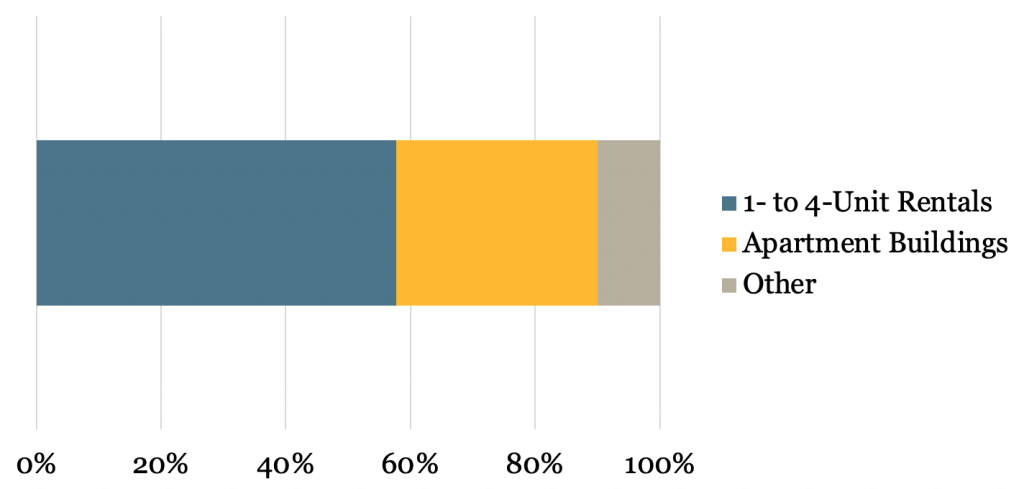

Recent Terner Center research has underscored how uneven the impacts of the pandemic have been on different tenants and types of landlords and has provided insights into where the greatest vulnerabilities may lie given the slow uptake of aid and loss of eviction protections. Of particular concern are the tenants and landlords of small-scale rental properties (1- to 4-unit buildings). These properties house a majority of tenants who are behind on rent (see Figure 1).

From February to April of 2021, we surveyed the owners of small rental properties to better understand how they have been faring since the onset of the COVID-19 pandemic. We asked owners about the pandemic, rent losses, and whether tenants or owners had accessed rent relief funds.

Figure 1: Tenant Households Who Reported Not Being Caught Up on Rent, By Property Type Data: Census Pulse Survey, Week 33, June 23-July 5

Data: Census Pulse Survey, Week 33, June 23-July 5

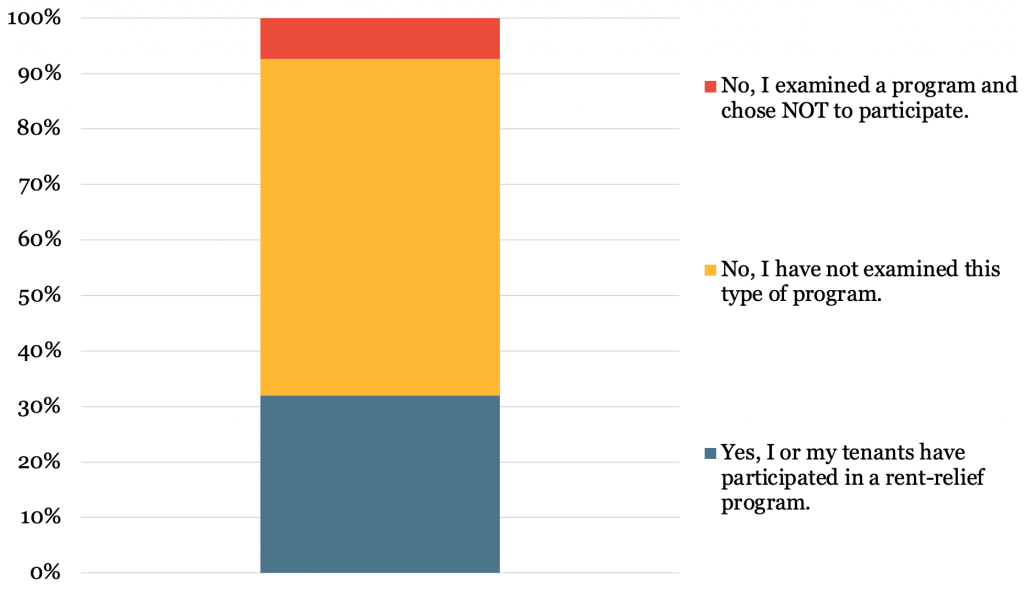

Among property owners reporting a pandemic-related rent delinquency, only 33 percent reported having participated in a rent relief program. This relatively low level of participation in emergency assistance programs was in part due to the timing of the survey; many programs funded by the first round of federal funds earmarked for rent relief were not yet accepting applications. Still, by the midpoint of the survey many programs funded with CARES Act dollars or state or private funding were in operation, and 26 of the 56 states and territories were already distributing federal relief dollars, as were 141 of the 335 local programs.

For those that participated in rent relief, one of the main findings of our survey was that rental property owners took an active role in driving program participation, working with their tenants to get rent relief. Interviews with owners who accessed emergency assistance revealed that they provided tenants with information about programs and even assisted them in completing application forms. These landlords were more likely to be among the more “professionalized” owners surveyed. For example, among owners experiencing rent delinquencies, those who used any technological tool to manage their properties, even as simple as spreadsheets, were twice as likely to have participated in a rent relief program.

For the two-thirds of landlords impacted by rent losses who had not accessed emergency assistance, our survey findings suggest the lack of participation was driven primarily by a lack of awareness of rent relief programs, as opposed to owners examining programs and choosing not to participate (see Figure 2). This is in keeping with the findings of another survey of small rental property owners, where about half of respondents were unaware of such programs.

Figure 2: Rental Property Owner Reported Participation in Rent Relief Programs Data: 2021 Terner Center Survey

Data: 2021 Terner Center Survey

Some owners who were unaware of rent assistance were themselves in dire need of it. One rental property owner in the Lansing, MI metro area reported that she was in the process of selling one of her four rental properties because she was unable to cover her expenses. Although three of her tenants had paid regularly during the pandemic, one tenant had not paid rent since March 2020. The owner was retired and recognized that she would be unable to cover the expenses for her portfolio by the time taxes came due. When asked about rent assistance she stated she was unaware of such a program, despite the fact that Michigan’s rent relief program was already accepting applications at the time of the interview.

To effectively deal with the large number of rent delinquencies among small rental properties, rent relief programs should expand outreach to non-professional landlords. This will be challenging, as many of these property owners do not have regular interactions with housing programs and are often not members of landlord associations. Direct mail efforts hold promise, as do text or phone communications. Informal networks, such as faith-based organizations or other community organizations, could also provide a pathway to reach these owners. Good program design is also essential, and for small rental property owners this should include providing multiple means of applying for funds, including non-online options. A lack of internet access has been identified as a problem among tenants, and it appears to be a problem among the owners of small rental properties as well. Dozens of small rental property owners who received our survey called the phone number provided to say they were interested in taking the survey but lacked the internet connectivity to do so. As state and local governments continue to market their programs and refine their practices, more effectively targeting and connecting with vulnerable landlords and tenants in small properties will be essential to staving off a spike in evictions as well as upheaval in the rental stock as some owners are forced to sell their properties.