It All Adds Up: The Cost of Housing Development Fees in Seven California Cities

Published On March 12, 2018

In the summer of 2017, the Terner Center embarked on a seemingly straightforward task: determine the amount and type of fees levied on new residential development in seven California cities. What was initially thought to be a clear assignment turned into an odyssey of combing through difficult-to-obtain fee schedules, cobbling together piecemeal information across city departments, and repeatedly interviewing various city planning officials.

The onerous and lengthy process our research team faced tells the story of the development fee process in California. While fees act as an important tool to mitigate the effects of new construction, the development and administration of these fees is often opaque and lacking oversight, greatly contributing to the complexity and cost of building new housing. These are the conclusions drawn by the Terner Center’s latest report in our Cost of Building Housing Research Series: It All Adds Up: The Cost of Housing Development Fees in Seven California Cities.

What do total development fees in certain California cities really amount to? How do cities determine their fees, and how are they implemented? How much of this information is available publicly? And what can be done to improve the implementation and structure of fees across the state? Our new report explores these questions through a comprehensive case study analysis of development fees in Berkeley, Oakland, Fremont, Los Angeles, Irvine, Sacramento and Roseville. From this research, we have revealed several problems with the way that development fees are currently implemented in California cities:

- Development fees are extremely difficult to estimate.

- Development fees are usually set without oversight or coordination between city departments, and the type and size of fees levied vary widely from city to city.

- Individual fees add up and substantially increase the cost of building housing.

- Projects are often subject to additional exactions not codified in any fee.

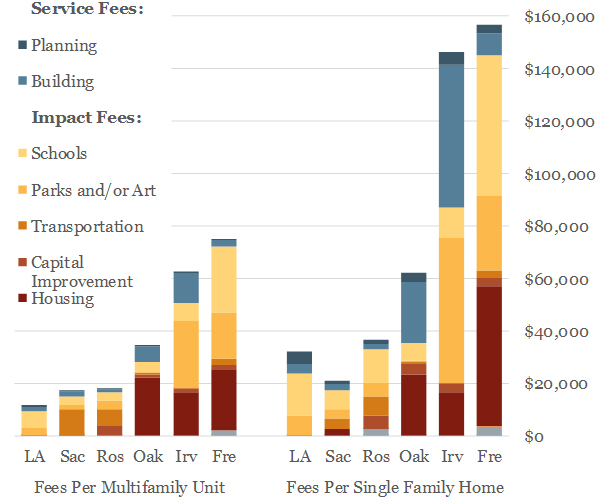

Sum of City Service and Impact Fees per Unit by Type Estimated for Prototypical Multifamily and Single Family Projects

These findings have significant implications for the cost and delivery of new housing in California. For example, our research found that total fees can amount to anywhere from 6 percent to 18 percent of the median price of a new home depending on location. Moreover, without standardized systems to estimate development fees, builders must rely on informal relationships with planners and building officials to obtain accurate estimates—a system that is neither reliable nor fair—and the unpredictability of these fees can delay or block projects altogether.

Moreover, the broad authority afforded to cities to levy fees results in wide variation of type and amount of fees between cities. For example, our research found that while one city requires new development to pay a park impact fee of $350 per single family home, another city requires a park impact fee of $55,000 per single family home.

What should be done to improve the way development fees are determined and implemented in California? In our report we make several policy recommendations for state and local policy that could greatly increase the transparency and efficiency of the structure and implementation of development fees, some of which have already been introduced in the state legislature. (1) As part of a broader set of actions to increase supply and housing affordability, these recommendations could have meaningful impact on California’s severe supply shortage and urgent affordability challenges.

(1) AB 3147 would prohibit a housing development project from being subject to a fee, charge, dedication, reservation or other exaction that is more than that in effect at the time that the application for the housing development project is determined to be complete.