COVID-19 and California’s Vulnerable Renters

Published On August 4, 2020

As the COVID-19 pandemic continues unabated, another rent day has come and gone. But August 1st marked a new chapter in the crisis—the first time rent has come due since Congress allowed key CARES Act provisions, including expanded unemployment insurance and a limited ban on evictions, to expire. Those CARES Act supports acted as a critical backstop for millions of renters who lost income as a result of efforts to slow the spread of the virus. The need for that backstop has arguably intensified as some shutdowns continue into their sixth month and others that had begun to lift have been reinstated. Yet, the federal government continues to stall on the critical actions needed to avoid the wave of housing insecurity and evictions looming across the country.

The extent of the need, and federal inaction even as the CARES Act “cliff” materialized, has prompted California and many localities to pursue their own relief and protection measures aimed at vulnerable renters, albeit at much smaller scales given their limited resources.

California led the wave of shelter-in-place measures enacted across the nation to slow the spread of COVID-19, yet it also became the first state to register more than 500,000 cases of the virus. In response to the severity of the pandemic and its economic fallout in a state already locked in a housing affordability crisis, state and local policymakers are considering, and in some cases have already adopted, measures to help hard-hit renters weather this pandemic-caused downturn and curb potentially significant increases in housing insecurity, eviction, and homelessness. To help inform those efforts, this analysis provides updated estimates of the scale and distribution of COVID-19-related impacts on California’s renters.

Even as the partial re-opening of businesses in April and May led to a slight rebound in jobs in the state, employment loses related to COVID-19 still left more than 2.8 million Californians unemployed in June.

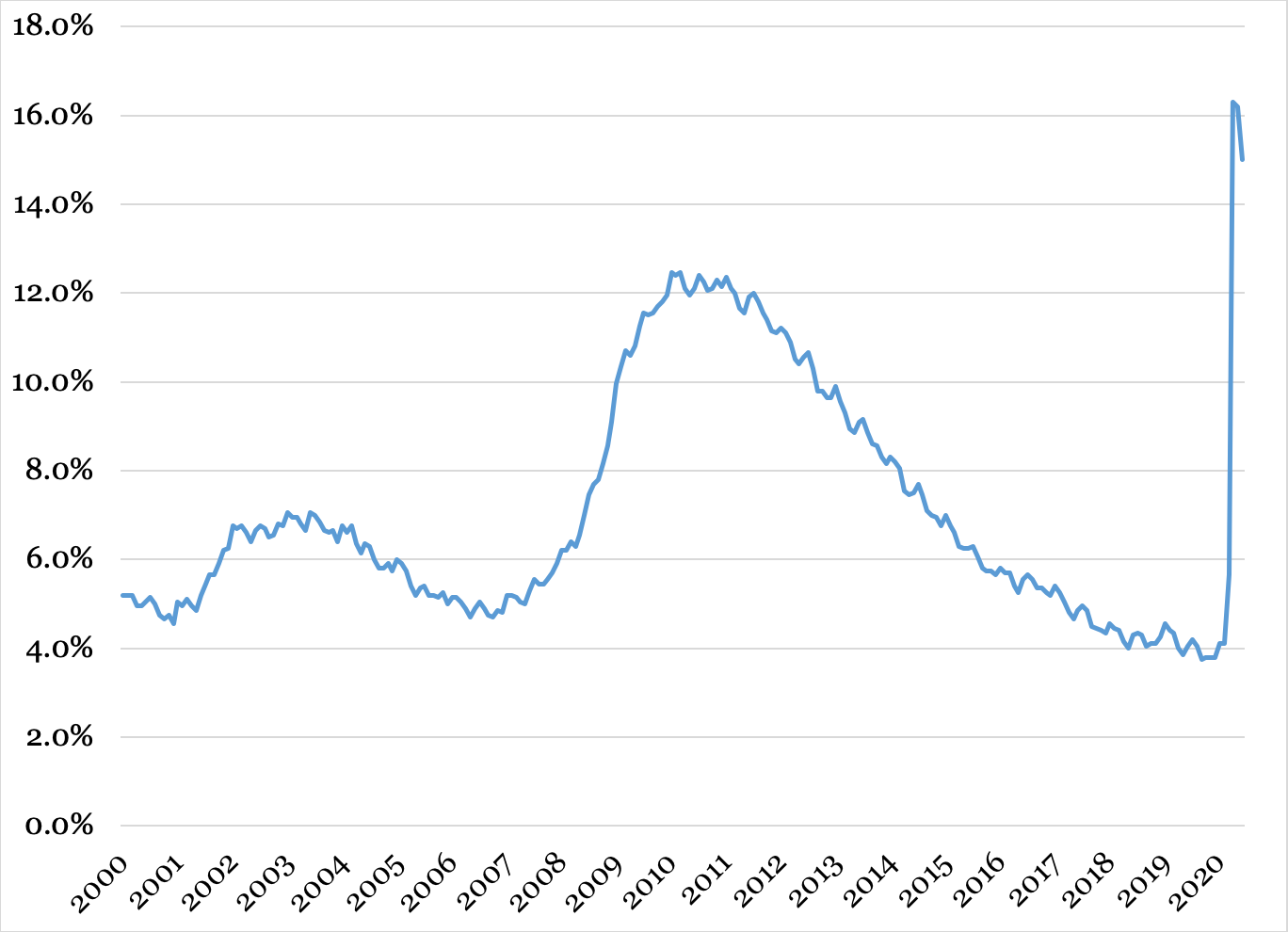

June’s jobs report brought positive news: California added more than half a million jobs compared to May, and the unemployment rate fell 1.5 percentage points, as many communities across the state moved toward reopening businesses that had been curtailed to flatten the curve of the pandemic (Figure 1). However, even with this progress, California’s June unemployment rate (14.9%) still outstrips the state’s peak during the Great Recession (12.3%) and is 10 percentage points higher than it was in February (4.1%).

Figure 1. California’s Monthly Unemployment Rate

Source: Terner Center analysis of Local Area Unemployment Statistics, California Employment Development Division, accessed online at https://www.labormarketinfo.edd.ca.gov/data/unemployment-and-labor-force.html

Source: Terner Center analysis of Local Area Unemployment Statistics, California Employment Development Division, accessed online at https://www.labormarketinfo.edd.ca.gov/data/unemployment-and-labor-force.html

While June’s estimates mark an improvement over April—when the most stringent shelter-in-place orders were in effect—that improvement may be short-lived. With COVID-19 cases on the rise across the state, Governor Newsom and localities across the state have shut down many activities that had just begun to come back, suggesting that, at least in the near term, we are likely to see unemployment numbers worsen rather than continue to improve.

How these job losses are impacting renters—as well as the repercussions of this crisis for increased evictions and homelessness—has been of grave concern. However, timely U.S. Bureau of Labor Statistics data on employment and earnings do not include household information. That means they do not offer direct insight into whether workers rent or own, or how much of their household’s income goes toward housing costs—key indicators needed to understand the scope of renter vulnerability stemming from the current downturn.

In a previous analysis—before BLS data on near-term economic impacts were available—we looked to data on renters working in industries vulnerable to COVID-related employment losses to get a sense of the potential scale and distribution of households that could be facing income or job losses because of shelter-in-place orders. Now, several months into the ongoing crisis, we can use monthly employment data (adapting a methodology developed by the Urban Institute, which is explained in more detail below) to estimate the impact of the COVID-19 pandemic on rental households within and across California. While the numbers presented in this analysis are likely conservative (as described below) and are not as precise as if we were able to collect real-time data, they nevertheless paint a valuable picture of the scale of the crisis and emphasize the need for legislative action to protect vulnerable renters.

As of June, nearly 1 million renter households in California have experienced a job loss as a result of the economic impacts of COVID-19, placing households at risk of housing insecurity and evictions.

Job losses have disproportionately affected workers in industries affected by stay-at-home orders—such as retail, entertainment, accommodation, and food service—and workers in those industries are more likely to be renters. Using county-level data on unemployment trends by industry, we estimate that nearly 1 million renter households (903,000) have at least one worker who has experienced a COVID-related job loss since February. That represents nearly 1 in 7 renter households in California (Figure 1). Almost half of these renter households are families (422,000) with children.

For most impacted renters, lost employment earning represent more than half of their household income, and that is especially true for lower-income households that are already more likely to be housing cost-burdened.

The short-term assistance provided through the CARES Act—including the one-time stimulus payment and expanded Unemployment Insurance benefits—have helped many vulnerable households weather income losses due to the pandemic. The expiration of those benefits leaves impacted households especially vulnerable to housing instability, particularly if they were already struggling to pay the rent before the pandemic.

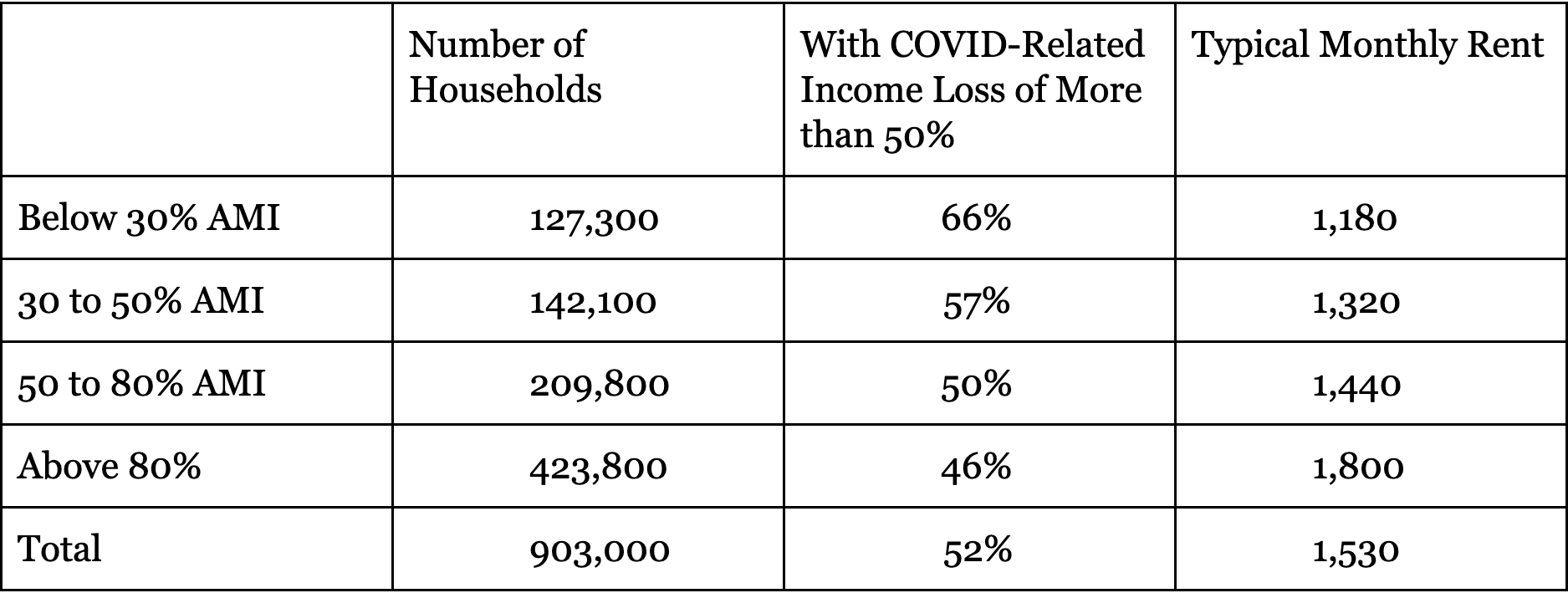

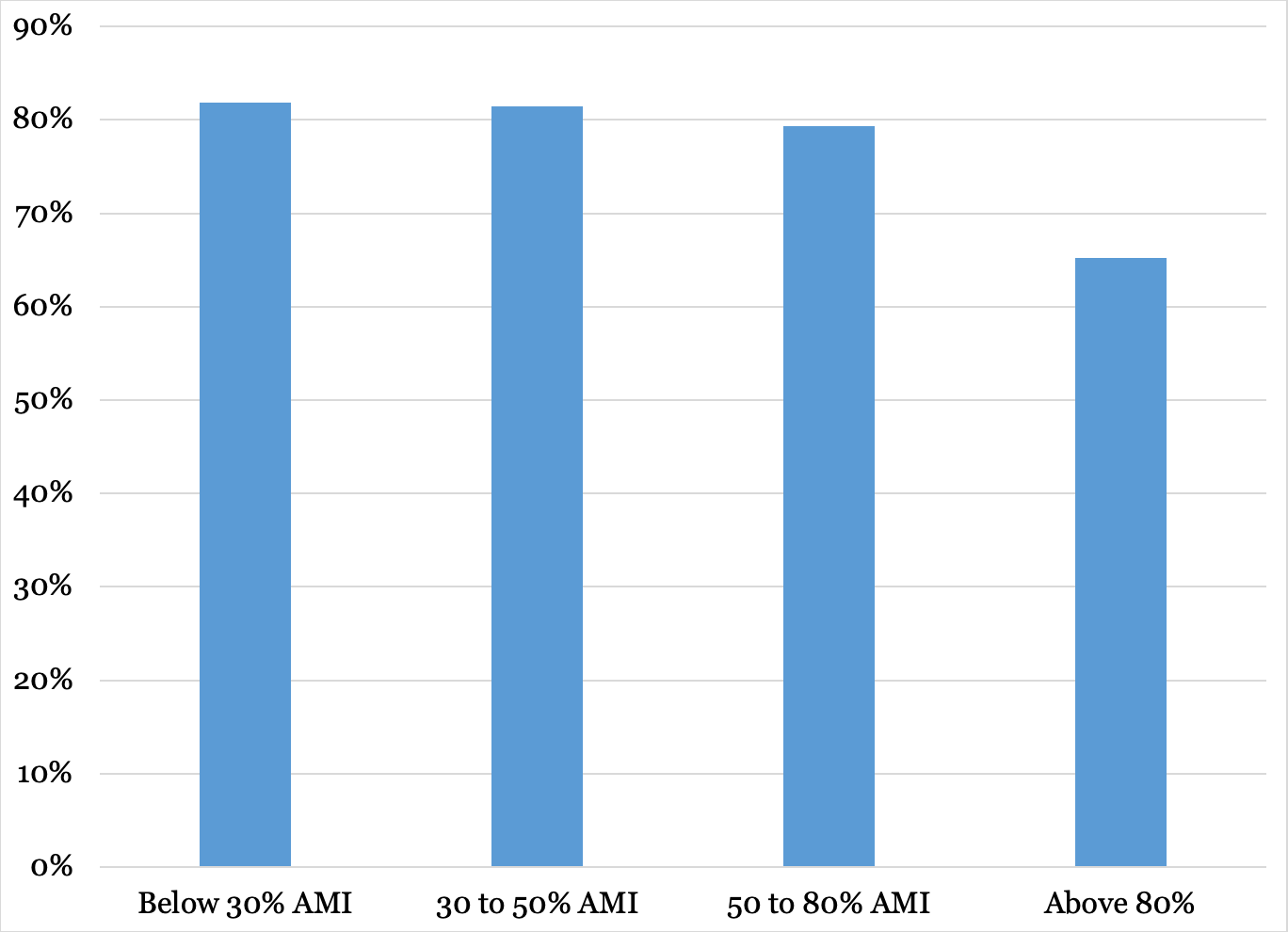

For more than half of California’s renter households that have at least one adult who has experienced a COVID-related job loss, those job losses took away the majority of their total household income (Table 1). The income loss is particularly stark for households that were already low-income. Extremely Low-Income (ELI) households (those that earn less than 30% of the area median income, which on average translates to under $18,000 a year) were already at risk of housing instability and homelessness before the pandemic. We estimate that, among the more than 127,000 ELI renter households in California that have experienced a COVID-related job loss, two-thirds have lost more than half of their total household income—an especially alarming prospect given that 93% of impacted ELI households were already housing cost-burdened before the pandemic—and its economic fallout—hit (Figure 2).

Table 1. California Renter Households with a COVID-Related Job Loss, by Income Level, Magnitude of Income Loss, and Monthly Rents Source: Terner analysis of American Community Survey PUMS data and unemployment statistics from the U.S. Bureau of Labor Statistics Current Employment Survey. Estimates have been rounded.

Source: Terner analysis of American Community Survey PUMS data and unemployment statistics from the U.S. Bureau of Labor Statistics Current Employment Survey. Estimates have been rounded.

The economic fallout from the pandemic is increasing the number of households—among them many higher-income households—who will face challenges paying rent and making ends meet.

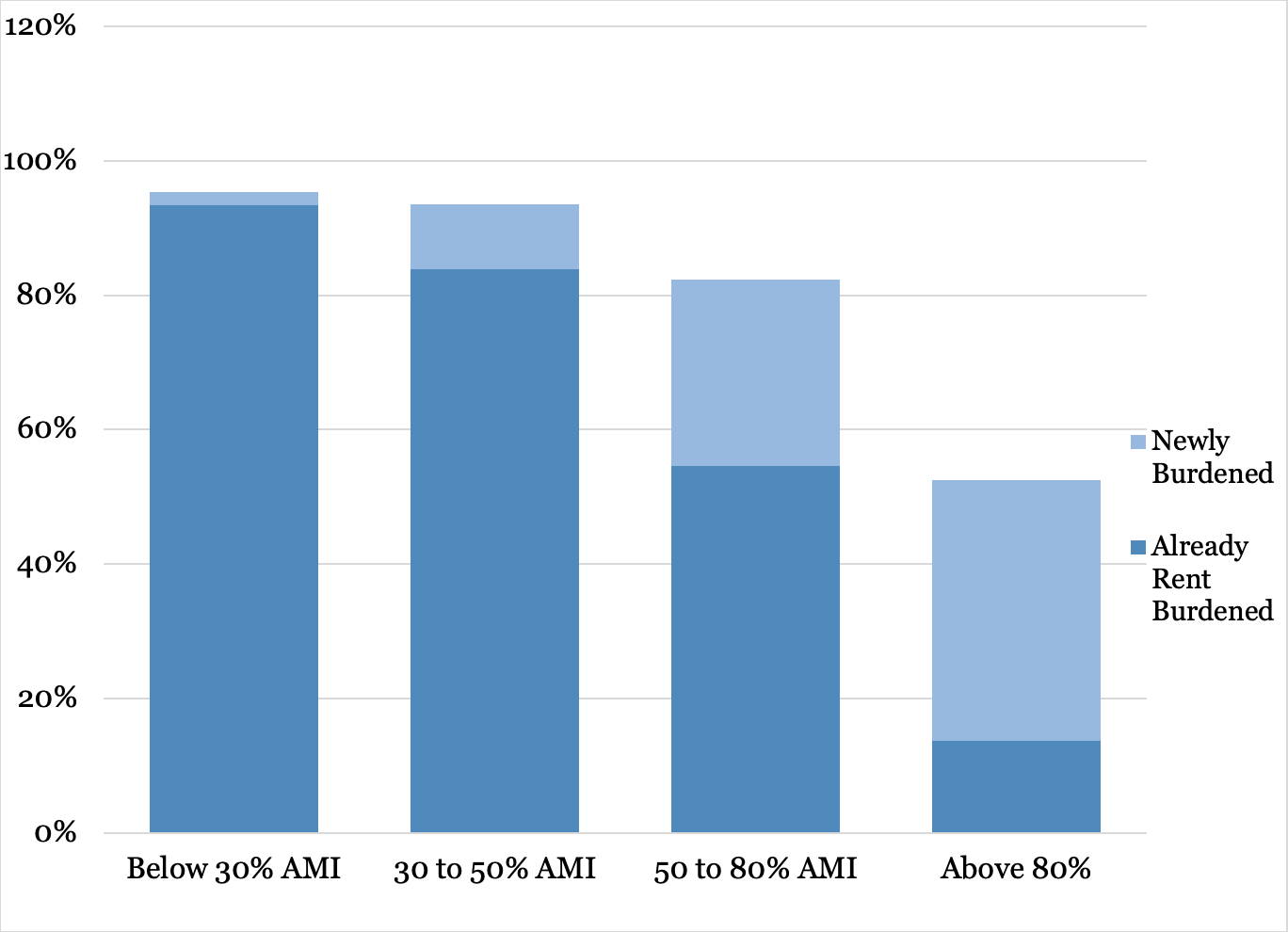

Among renter households impacted by COVID-related job losses, 411,000 were already rent-burdened, meaning that they were spending more than 30 percent of their income on rent. But since the crisis hit, an additional 239,200 rental households are newly-cost-burdened. While ELI households have long struggled with cost burdens and housing insecurity, those earning incomes above the median are now also confronting the challenge of paying high rents (Figure 2). Among households earning between 50 and 80 percent of AMI (around $60,000 in most parts of California), COVID-related job losses have put an additional 58,000 households (28%) in the situation where their housing costs exceed what is affordable. Even among those earning 80 percent of the median and above (who are often ineligible for housing subsidy programs), more than half of COVID-impacted renter households are now cost-burdened.

Figure 2. Renter Households with At Least One Job Loss by Income and Housing Cost Burden Source: Terner analysis of American Community Survey PUMS data and unemployment statistics from the U.S. Bureau of Labor Statistics Current Employment Survey

Source: Terner analysis of American Community Survey PUMS data and unemployment statistics from the U.S. Bureau of Labor Statistics Current Employment Survey

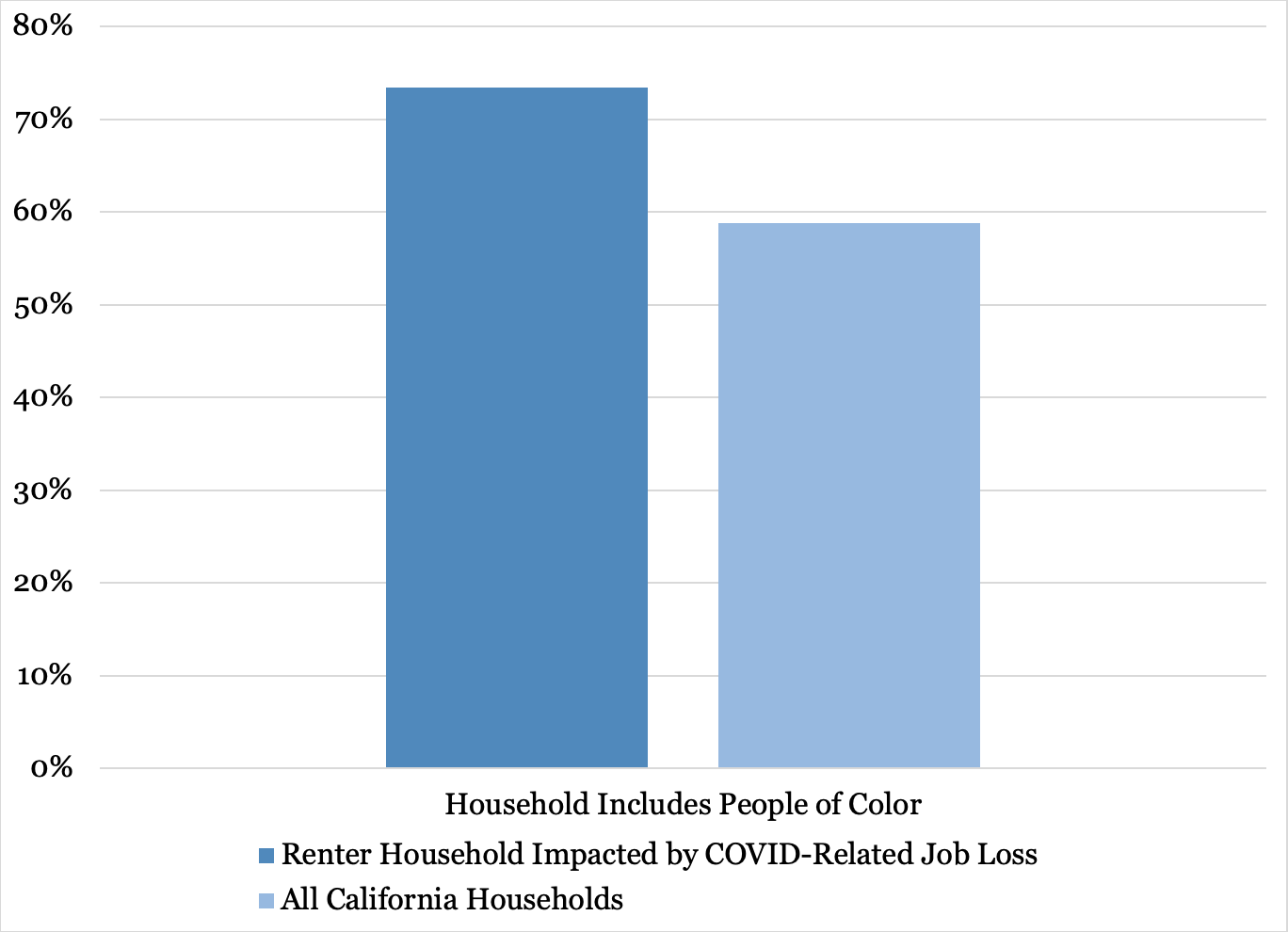

Among renter households estimated to have experienced a COVID-19-related job loss in California, nearly three-quarters house at least one person of color.

This pandemic-driven economic crisis, layered on top of an already-severe housing crisis, has thrown into sharp relief the systemic racial inequities embedded in our employment and housing markets. According to national data, the June unemployment rate for Black workers was 15.4%, compared to 14.5% for Latinx workers, 13.8% for Asians, and 10.1% for Whites. While we can’t directly measure levels of job losses by race and ethnicity within a specific industry, the data show that renter households of color in California have been disproportionately affected by the crisis. We estimate that nearly three-quarters of the 903,000 renter households affected by COVID-related job losses are households of color—meaning they include at least one Black, Latinx, Asian, or other person of color (Figure 3).

Figure 3. California Households That Include Residents of Color, by Renter and COVID-19-Related Job Loss Status

Source: Terner analysis of American Community Survey PUMS data and unemployment statistics from the U.S. Bureau of Labor Statistics Current Employment Survey

Source: Terner analysis of American Community Survey PUMS data and unemployment statistics from the U.S. Bureau of Labor Statistics Current Employment Survey

Those shares climb even higher for lower-income households that have experienced a job loss (Figure 4). Among low-income households that have been impacted by COVID-related job loss, we estimated that more than 80% are households of color.

Figure 4. Share of California Renter Households Impacted by COVID-Related Job Loss That Include Residents of Color, by Income

Source: Terner analysis of American Community Survey PUMS data and unemployment statistics from the U.S. Bureau of Labor Statistics Current Employment Survey

Source: Terner analysis of American Community Survey PUMS data and unemployment statistics from the U.S. Bureau of Labor Statistics Current Employment Survey

Failing to address the housing instability facing lower-income renter households impacted by COVID-related job losses means the brunt of the looming eviction crisis will be borne disproportionately by people of color. If that comes to pass, it would only worsen racial inequities that have long barred communities of color from pathways to economic mobility and wealth-building in this country.

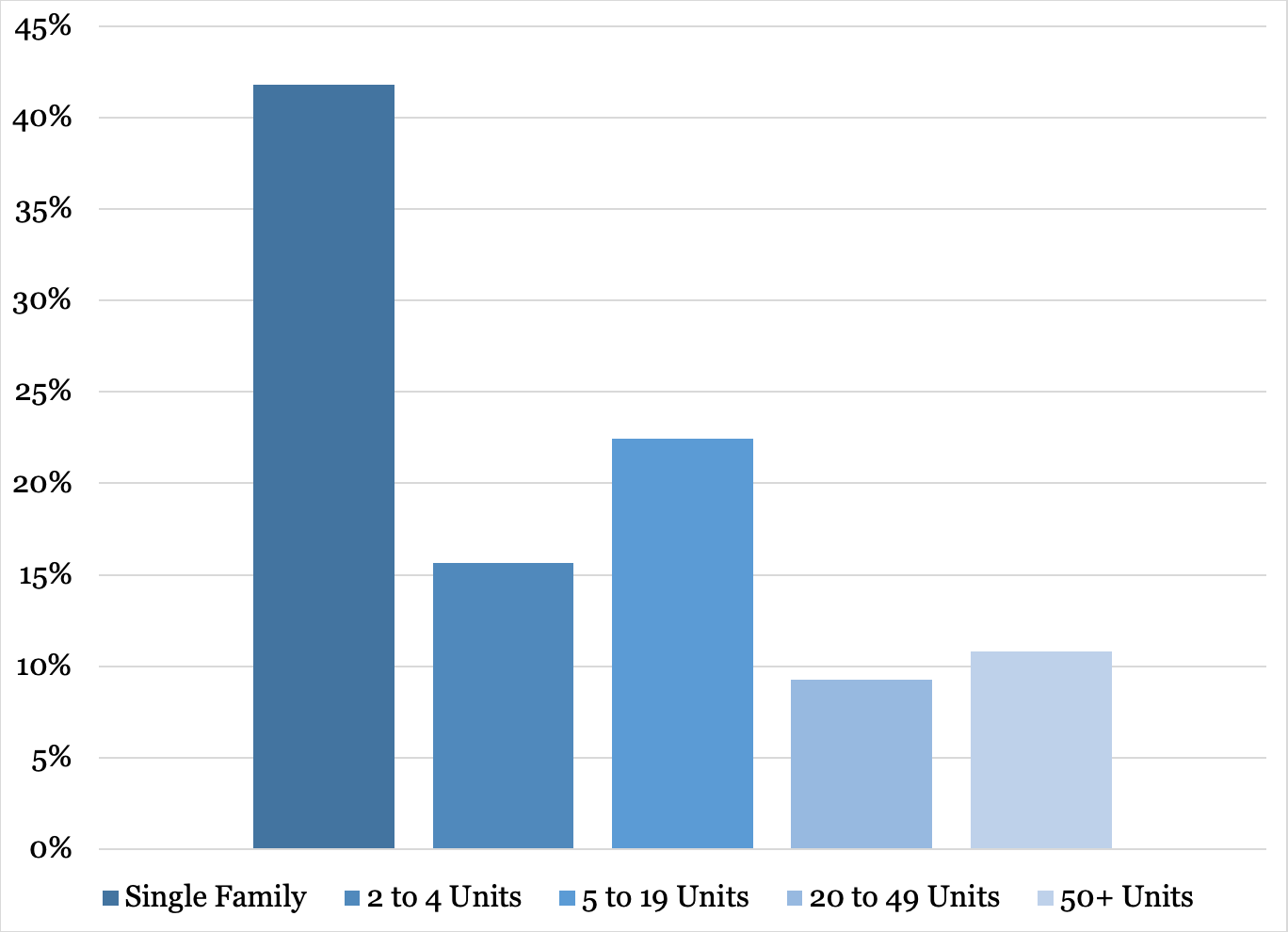

The majority of impacted renter households live in single-family rentals or smaller buildings, which are often owned by smaller landlords.

Among California renter households that have experienced a job loss since February, 42% live in a single-family home, 16% live in a building with 2 to 4 units, and another 22% live in a building with 5 to 19 apartments (Figure 5). That distribution shifts somewhat by income category, but the overall pattern holds: most renters impacted by a recent job loss (even the most vulnerable ELI households) do not live in large multifamily properties.

Figure 5. Distribution of Renter Households with a COVID-Related Job Loss, by Building Type Source: Terner analysis of American Community Survey PUMS data and unemployment statistics from the U.S. Bureau of Labor Statistics Current Employment Survey

Source: Terner analysis of American Community Survey PUMS data and unemployment statistics from the U.S. Bureau of Labor Statistics Current Employment Survey

That is a meaningful distinction for two reasons. First, renters in single-family homes and owner-occupied duplexes are not covered by the recently-adopted statewide rental protections that guard against egregious rent increases and require “just cause” for evictions. Second, smaller properties often belong to smaller landlords, including “mom and pop” owners, while larger properties are more likely to be owned by institutional investors. Smaller landlords may not have the reserves to withstand sustained decreases in their rent collections. A recent survey of rental property owners and managers suggests that the experience of smaller landlords has been somewhat more precarious than what larger landlords have reported so far in the pandemic. The majority of survey respondents reported that their rent collections had fallen in the second quarter of 2020, and 1 in 4 landlords reported that they had already borrowed money to cover their operating expenses. Such precarity among small landlords not only threatens the housing security of the tenant, but also the livelihood of the landlord. If small landlords cannot afford to maintain their properties that can also negatively impact the number of jobs that support the upkeep of those buildings as well as the long-term affordability of those rental units if the landlord ends up selling the property.

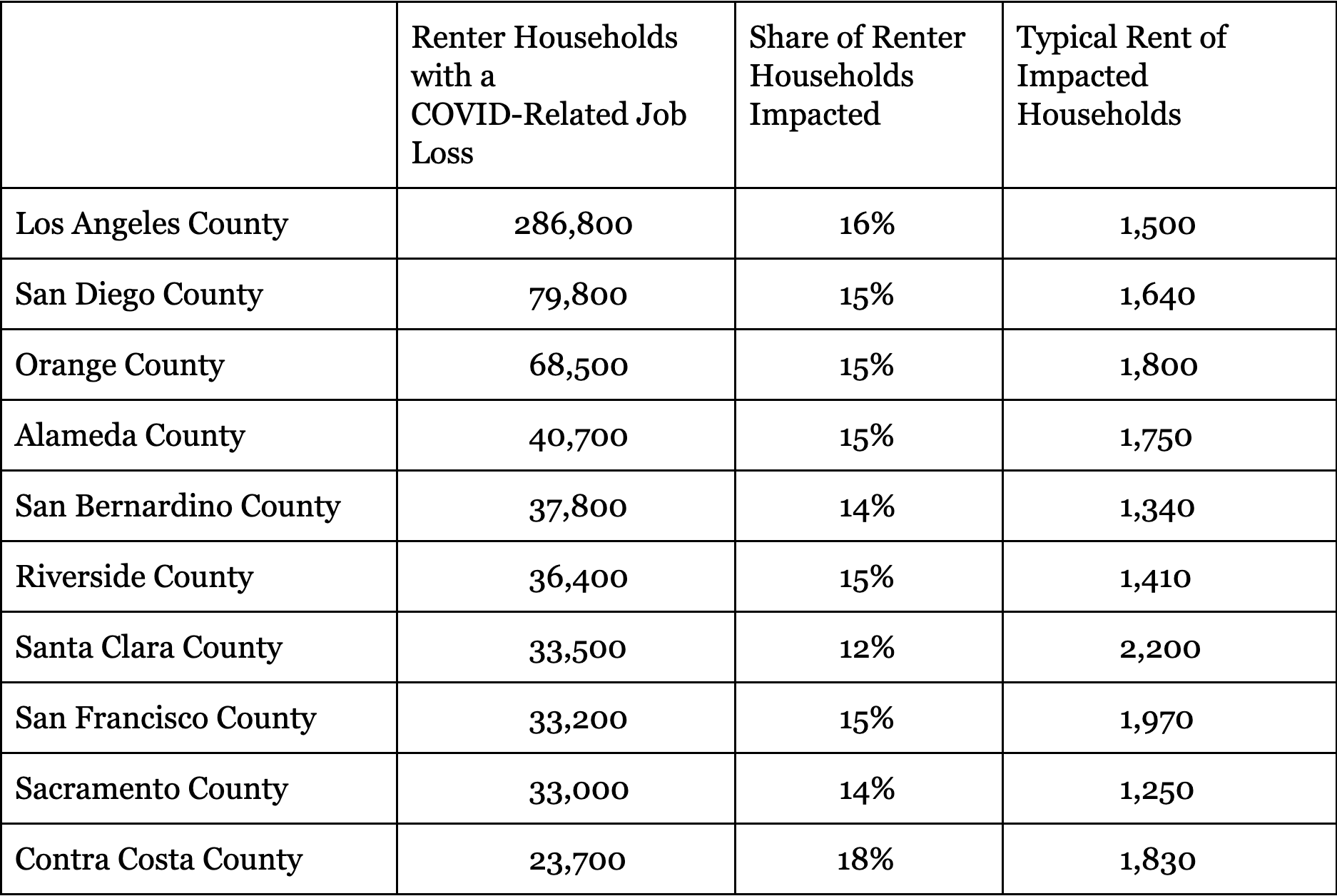

Three-quarters of impacted renter households live in 10 counties, with nearly one-third in Los Angeles county alone.

Every county in the state is home to renters affected by COVID-related job losses, but 3 out of 4 affected households are located in just 10 counties (Table 2). Most of these counties are also home to some of the state’s most expensive rents, where renters may have been struggling to make ends meet even before the additional aid provided by the CARES Act expired.

Table 2. Renter Households Impacted by COVID-Related Job Loss and Typical Rents

Source: Terner analysis of American Community Survey PUMS data and unemployment statistics from the U.S. Bureau of Labor Statistics Current Employment Survey. Estimates have been rounded

Source: Terner analysis of American Community Survey PUMS data and unemployment statistics from the U.S. Bureau of Labor Statistics Current Employment Survey. Estimates have been rounded

By far the largest number of impacted renters is in Los Angeles County, which is home to nearly 290,000 households that have experienced at least one job loss. The majority of LA County’s impacted households were already low-income before experiencing a job loss, and most saw their total household incomes fall by at least 50% after losing a job. The same can be said for impacted renter households in Alameda, Sacramento, and San Diego County as well.

The distribution of vulnerable households has significant implications for the neighborhoods and jurisdictions in which they are located. If these renters can’t pay rent and their landlords can’t cover operating costs, the negative ripple effects will extend far beyond the considerable hardships of those individuals and households. For one, it will impact local budgets, diminishing sales, income, and property tax revenue. At the same time, any increases in evictions or the unhoused population would put further strain on local systems and safety nets that are already capacity- and resource-constrained.

To explore county estimates in more detail download the appendix tables.

Conclusion

With no end to the pandemic in sight, unemployment rates outstripping the worst of the Great Recession, and the number of people reporting permanent (rather than temporary) unemployment rising, it is clear the path to economic recovery will be a long one. Even with the CARES Act benefits in place, analysis of the U.S. Census Bureau’s Household Pulse Survey data show that more than half of renters who reported recent job or income losses in their household also reported relying on multiple income sources to make ends meet—including using credit cards, dipping into savings or selling assets, or borrowing from family or friends. That suggests many renters have already tapped into whatever personal resources they may have to make up for lost income. Now the CARES Act provisions have lapsed and it is unclear what, if anything, might take their place. Without that federal assistance, and given the disproportionate impact of this downturn on lower-income households, the risk of housing insecurity, eviction, and homelessness will only intensify for impacted renters in the coming months.

Given the scale and depth of the crisis, federal policymakers must act to shore up the instability facing vulnerable renters across the country. As debates continue in Washington, leaving uncertainty about what that relief would look like and when it might actually come, California policymakers at the state and local level should act to provide some important near-term protections and support for those households most immediately at-risk.

A Note on Methods

As noted above, timely data on job losses and unemployment claims do not provide information on whether a person lives in a rental unit, nor data on their demographic characteristics, income, or rent burdens. To produce local estimates of renter households impacted by a COVID-19 job loss, we adapted a methodology developed by the Urban Institute to simulate job losses based on trends in monthly unemployment data. (Again, this approach differs from our earlier analysis that identified all renters households within a COVID-vulnerable industry as potentially impacted by a job or income loss.)

To run the simulation, we use data from the Current Employment Survey (CES) collected by the Bureau of Labor Statistics on the change in jobs from February to June by county and by industry. Because renters tend to experience unemployment at higher rates than homeowners, we then use the 2018 5-year American Community Survey (ACS) Public Use Microdata files to calculate a multiplier (the “renter ratio”), which is the ratio of the unemployment rate by industry for renters to the unemployment rate by industry for both renters and homeowners. We multiply changes in job loss by industry by this multiplier to get estimates of the number of job losses by industry for every county in California. Based on this estimate, we then randomly sample renters who had earned wages in the ACS to simulate job loss, using the household characteristics associated with that worker in the analysis. In some cases, particularly for smaller counties in California, the CES data did not include industry-specific data on job changes; in those cases, we relied on “All Non-Farm” job loss rates rather than industry specific job loss rates for our estimates. For 23 counties with smaller populations (Alpine, Amador, Calaveras, Colusa, Del Norte, Glenn, Inyo, Lake, Lassen, Mariposa, Mendocino, Modoc, Mono, Nevada, Plumas, San Benito, Sierra, Siskiyou, Sutter, Tehama, Trinity, Tuolumne, and Yuba), the Public Use Microdata Areas (PUMAs) they are associated with encompass multiple counties. In those cases, and in consideration of sample sizes, we present data for the aggregated area rather than breaking out individual counties.

The resulting estimates are likely an undercount of California renter households affected by COVID-19 job losses. We do not, for example, account for households who have seen a drop in earnings due to reduced hours, wages or furloughs, nor do we capture households who have an earner working in the informal sector.