The End of the Mortgage “Dark Age”: Fintech and the Equity Implications of Disruptive Technology in the U.S. Residential Mortgage Market

Published On January 14, 2019

As part of our commitment to the education and professional development of UC Berkeley students, the Terner Center highlights exceptional student work that connects to our mission and research agenda. The analyses and policy proposals put forth in these projects may not be reflective of the official position of the Terner Center.

As part of our commitment to the education and professional development of UC Berkeley students, the Terner Center highlights exceptional student work that connects to our mission and research agenda. The analyses and policy proposals put forth in these projects may not be reflective of the official position of the Terner Center.

A Professional Report submitted in partial satisfaction of the requirements for the degree of Master of City Planning in the Department of City and Regional Planning of the University of California, Berkeley, May 2018. The full report is available here.

Author: Alison Mills

Reviewers: Carolina Reid and Carol Galante

Despite the rapid growth in the share of the mortgage market held by financial technology (“fintech”) lenders, the loans originated by fintech companies have not been adequately studied, raising questions about the types of products being offered, the effects of technology on their financing, and ultimately the equitable access to this debt. The report reveals that while fintech improves access to the mortgage application for low-income and minority groups, Black applicants are more likely to be denied by a fintech lender than by a traditional bank. The report also finds that Fintech lenders show significant market penetration in cities that were hit the hardest during the Recession.

Report Summary

THE END OF THE MORTGAGE “DARK AGE”? FINTECH AND THE EQUITY IMPLICATIONS OF DISRUPTIVE TECHNOLOGY IN THE U.S. RESIDENTIAL MORTGAGE MARKET

At the beginning of 2016, Quicken Loans introduced Rocket Mortgage to the nation, and less than two years later, became the largest mortgage lender in the country. Since 2008, Quicken has increased its mortgage volume eightfold, but it is far from the only online lender making strides into the U.S. residential mortgage market. In the last 10 years, traditional, commercial banks’ market share of residential mortgage lending has declined from 74 percent to 52 percent. During this same time period, non-bank mortgage lenders and financial technology lenders (referred to from here simply as “fintech” lenders), who conduct nearly the entire mortgage origination process online, have increased their total market share from about 5 percent to well over 15 percent.

The implications of the rise of fintech lending are still unclear. Introducing internet technology into the mortgage origination process has the potential to make mortgages cheaper and more accessible by reducing the costs of information and by hosting all necessary services on a single digital platform. Technology has allowed fintech lenders to use big data approaches to customize their assessment of borrower default risk through complex, sophisticated algorithms, thereby assessing credit risk differently than traditional banks.

However, we don’t know whether the rise of fintech and these new approaches to assessing risk make mortgages more or less accessible for homebuyers across different demographic groups. Since online mortgage lending may present new and disproportionate income, language, or other data-determined barriers for lower-income, non-white, or rural households, it is important to examine the equity issues raised by these new technologies.

Using loan-level mortgage application data collected under the Home Mortgage Disclosure Act (HMDA) from 2016, which provides the borrower’s race, income, loan amount, census tract information, loan type, application outcome, and lender’s identity, I compared origination outcomes for low-income and minority groups applying to both traditional and fintech lenders. In a capstone project for my Master’s of City Planning, I explored this topic in depth to understand 1) whether fintech expands access to credit and 2) where geographically fintech has penetrated the market most.

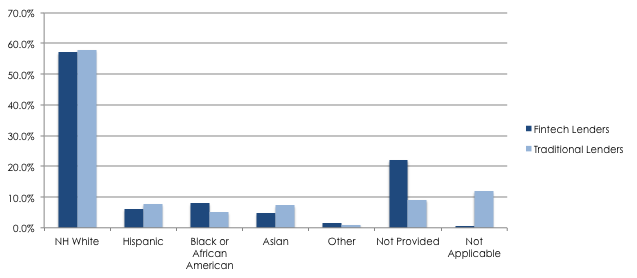

The results of my analysis suggest that fintech improves access to the mortgage application process for African Americans – a group that has traditionally been underserved by mortgage lenders (Figure 1). On average, a greater share of African Americans submit applications to fintech lenders compared to traditional lenders: whether this is due to strategic targeting and marketing on the part of fintech lenders or due to a less burdensome application system is unclear. However, what is also striking is that among mortgage applicants to fintech lenders, a much greater share do not report race or ethnicity information. Fully 22 percent of fintech applications do not include information about the borrower’s race or ethnicity.

FIGURE 1. RACE OF APPLICANTS – NATIONAL LEVEL

This missing data makes it much more difficult to assess whether there are racial disparities in approval or denial rates. For several fintech lenders, the missing data can affect more than half of all applications in the dataset.

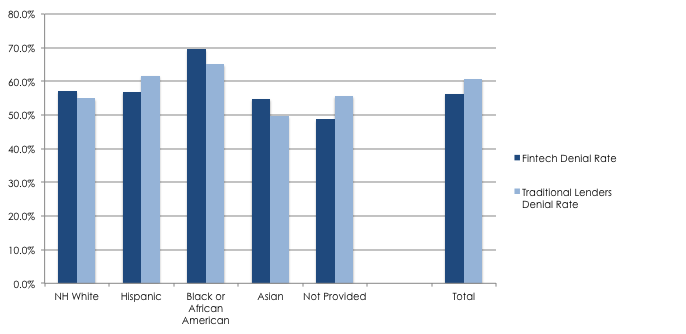

Despite the predominance of missing race information, the data still reveal that, even when holding income and other factors (1) constant, African American applicants are more likely than non-Hispanic White applicants to be denied by a fintech lender. Fintech’s denial rate of black applicants is also higher than that of traditional banks (Figure 2), suggesting that racial disparities exist in the access to fintech mortgage credit.

FIGURE 2. DENIAL RATE BY RACE – NATIONAL LEVEL

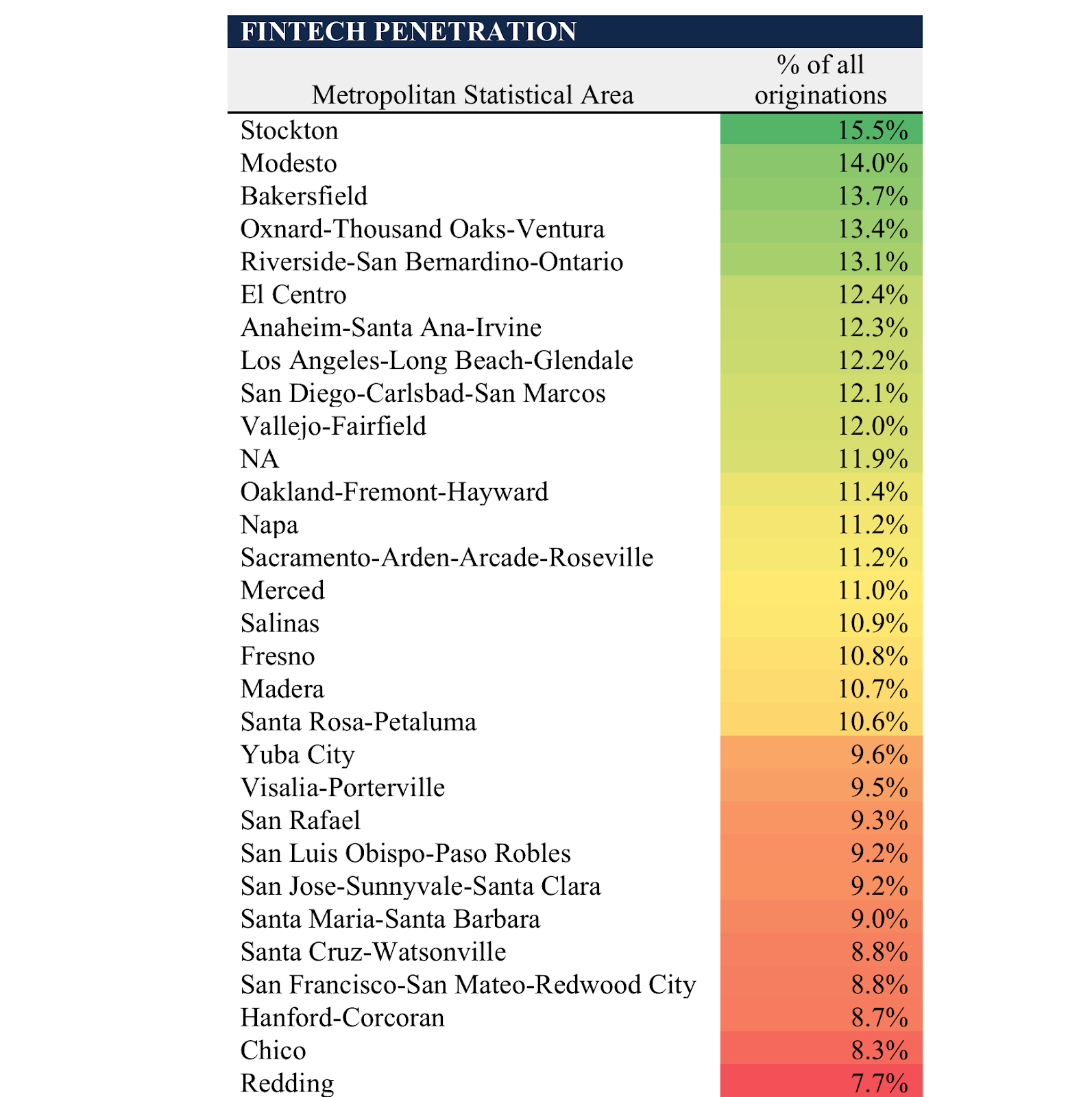

Lastly, I also find that fintech lenders show the greatest market penetration in cities that were hit hardest during the recession (Figure 3). Taking a deeper dive into mortgage data in California specifically, fintech lenders have made the deepest inroads in less expensive markets that may better conform to federal loan limits and in markets whose home values showed deep declines during the subprime mortgage crisis but have since rebounded dramatically. Fintech lending is also highly correlated with the recent growth in the median home values of an area.

FIGURE 3. GEOGRAPHIC PENETRATION OF FINTECH LENDING

While the introduction of technology in the mortgage market has the potential to increase the ease of applying for and accessing mortgage credit, this has not yet fully materialized in practice. My research has demonstrated that fintech credit is concentrated in certain areas and may be less accessible for particular low-income and minority groups. The lending practices of fintech lenders should continue to be studied to identify and prevent potential discriminatory practices.

(1) The model controlled for applicant income, loan amount, loan type, and location of applicant.